In an era where almost everything is digital, from banking and shopping to education and healthcare, knowing who’s on the other side of the screen is critical. Identity verification is no longer just a security measure; it’s the backbone of trust in every digital interaction. Whether you’re opening a bank account, signing a lease, or accessing your medical records, identity verification is what ensures that the person gaining access is actually you.

But what exactly does identity verification entail? Why has it become so central to the modern digital ecosystem? And how can businesses implement it effectively while maintaining user privacy and experience? Let’s break it all down.

What is Identity Verification?

Identity verification is the process of confirming that a person is who they claim to be. It’s a simple idea, but in a world where so much happens online, getting it right has become more important than ever.

Whether you’re opening a bank account, signing up for a digital service, or logging into a secure system, chances are some form of identity check is involved. These days, it usually happens digitally: through ID scans, selfies, facial recognition, or even background checks against official databases. It’s all about making sure that the person on the other side of the screen is legitimate.

Businesses rely on digital identity verification to protect against fraud, follow regulations like KYC and AML, and build trust with their users. For individuals, it means faster access to services without needing to visit an office or stand in line.

At its core, identity verification is about keeping people and systems safe while making everyday interactions more convenient.

Why Is Identity Verification Important?

Identity verification is no longer just a nice-to-have, it’s a vital part of how modern businesses operate. Here’s why it matters more than ever today:

1. Security & Fraud Prevention

With the rise of cybercrime, phishing, and data breaches, it’s easier than ever for bad actors to steal personal information and impersonate others. In fact, there were 1,135,291 reported cases of identity theft and 449,032 cases of credit card fraud in 2024, according to the FTC. Identity theft can lead to financial loss, reputational damage, and even legal consequences for both users and businesses. Robust identity verification helps prevent such scenarios by ensuring only authorized individuals gain access to systems and services.

Imagine a fraudster trying to open a bank account using stolen personal information. Without proper verification, they might succeed. But with biometric checks or database cross-referencing, the attempt is immediately flagged and blocked. It’s the first and most critical defense line against fraud.

2. Compliance With Regulations

Governments worldwide have rolled out regulations like KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR (General Data Protection Regulation) that require businesses to verify the identity of their users or customers. These laws are in place to prevent financial crimes, terrorism financing, and data misuse.

Non-compliance isn’t just risky, it’s costly. Fines can reach millions, and the reputational hit can be irreversible. Proper identity verification ensures organizations stay on the right side of the law while offering legitimate services.

3. Customer Trust & Reputation

When users feel safe, they’re more likely to engage with your business. Implementing secure identity verification signals that you take their safety seriously. It builds trust and creates a better customer experience.

On the flip side, lax identity processes can turn your platform into a playground for scammers. Once word gets out, it’s hard to rebuild trust. Investing in secure identity systems means investing in your brand’s integrity.

4. Enabling Digital Services

As services continue to move online, identity verification becomes the gateway. Want to open a digital bank account? Apply for a visa online? Attend a virtual class? Digital Identity verification is what makes all this possible.

It removes geographical barriers and allows users to access services anytime, anywhere, securely and confidently. It also simplifies user onboarding, reduces paperwork, and accelerates time-to-service.

Common Methods of Identity Verification

Depending on the risk level, regulatory environment, and user expectations, businesses can use different types of identity verification. And with the market expected to reach $39.82 billion by 2032, the question isn’t whether to invest in identity verification, it’s how soon.

Here are the some of most common identity verification methods:

1. Document-Based Verification

This is one of the most common forms of digital identity verification. Users are asked to upload a clear image of a government-issued ID (passport, national ID card, driver’s license) along with a selfie. Advanced algorithms check for document authenticity, such as holograms, fonts, and layouts while matching the ID photo with the selfie.

It’s widely used in sectors like finance and travel. However, it can be vulnerable to forged documents, so it’s often combined with additional verification methods.

2. Biometric Verification

Biometric verification uses unique physical characteristics like facial features, fingerprints, iris patterns, or even voice for authentication. These traits are nearly impossible to replicate, making biometrics one of the most secure verification methods.

For instance, unlocking a banking app with Face ID is a biometric process. It’s fast, seamless, and user-friendly. The only concern is privacy as many users are wary of how their biometric data is stored and protected.

3. Knowledge-Based Authentication (KBA)

In this ID verification method, users answer personal questions based on their historical data, like a previous address, the name of their first pet, or the bank where they had their first account. While it was widely used in the early days of online services, it’s now considered insecure.

Why? Because so much personal data is publicly available or has been leaked in data breaches. Hackers can easily find the answers, defeating the purpose of KBA.

4. Zero-Knowledge Proof Verification

As privacy concerns grow, ZKPs (zero-knowledge proofs) are increasingly being adopted by platforms aiming to confirm user identities without compromising privacy. Whether it’s proving age or verifying identity, users can do so without exposing any sort of personal information.

A big step forward in this space is ZK Face Proof, the world’s first and only facial verification solution powered by zero-knowledge cryptography. With just a quick face scan, ZK Face Proof allows businesses to securely verify a user’s identity without storing any biometric data. It’s fast, private, and smart, with built-in liveness detection that blocks spoofing and deepfake attempts.

While traditional ZKPs have primarily been used in the crypto world, ZK Face Proof works across both Web2 and Web3 environments. It’s also versatile enough to work both online and offline, making it an ideal and practical solution for businesses that want to prioritize privacy in their identity verification process.

5. Two-Factor and Multi-Factor Authentication (2FA/MFA)

These methods combine two or more elements: something you know (password), something you have (OTP on your phone), and something you are (biometrics).

2FA adds an extra step that greatly improves security. Even if a hacker gets your password, they can’t log in without the OTP or biometric confirmation. MFA takes it further by requiring multiple types of authentication.

6. Database Verification

Here, user-submitted information is checked against trusted databases like credit bureaus, tax authorities, or national registries. It’s an effective way to validate name, address, SSN, and more.

It’s often used by banks and fintech platforms during onboarding. It’s fast, but can occasionally produce false negatives if the data is outdated or mismatched.

How the Identity Verification Process Works

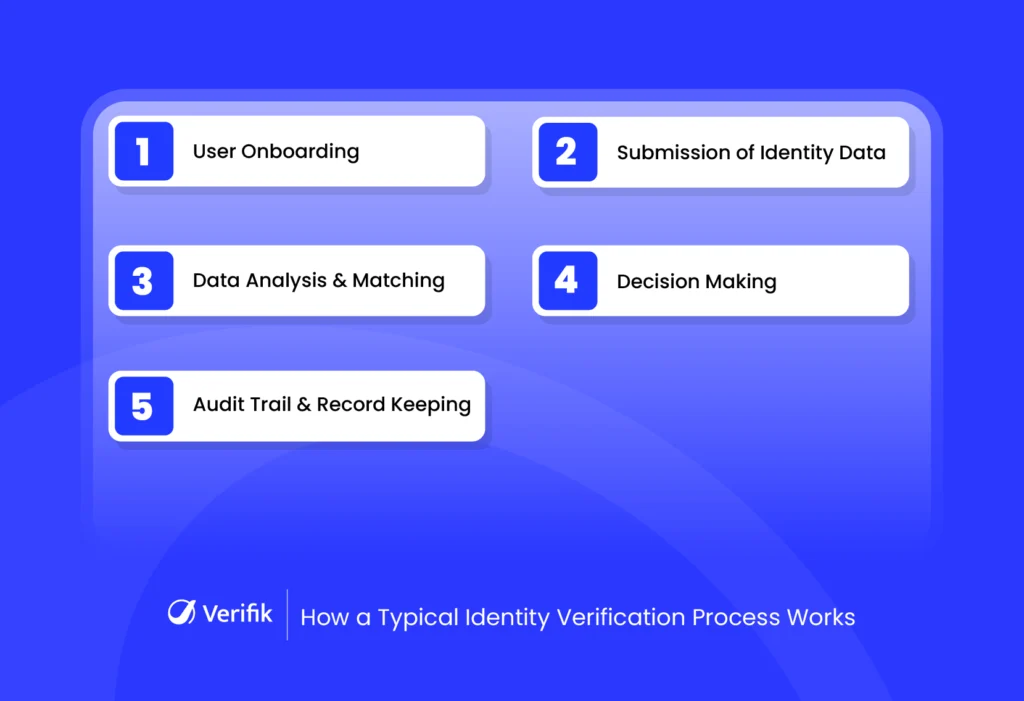

Though methods vary, most identity verification processes follow this flow:

Step 1: User Onboarding

It begins when the user tries to sign up or gain access. This can happen through a website, mobile app, or even a physical kiosk. They’re prompted to start the verification process.

Step 2: Submission of Identity Data

Users provide the required information or documents. This could be a photo of their ID, a real-time selfie, biometric scan, or basic personal details. The process should be smooth, with prompts to guide the user.

Step 3: Data Analysis & Matching

The system then analyzes the submitted data. OCR extracts text from documents. AI checks for tampering. Facial recognition software compares the selfie to the ID photo. If biometrics are used, the scan is checked against stored templates.

Step 4: Decision Making

Based on the analysis, the system either approves, denies, or flags the attempt for manual review. Speed is key here as users expect instant results, and businesses benefit from automation.

Step 5: Audit Trail & Record Keeping

Finally, all actions are logged with metadata like timestamps, device type, and geolocation. This is essential for regulatory compliance, dispute resolution, and ongoing monitoring.

Use Cases of Identity Verification

Identity verification isn’t limited to one industry, it’s crucial in any sector that values security, compliance, and trust. Here are some major industries where identity verification plays a critical role:

1. Banking and Financial Services

Banks and fintech platforms rely heavily on identity verification to meet KYC and AML regulations, prevent fraud, and streamline onboarding. It’s used during account opening, loan applications, credit checks, and money transfers.

Instant identity verification allows banks to offer digital onboarding with minimal friction. Customers can sign up from their smartphones, complete ID verification within minutes, and start transacting, all without stepping into a branch.

2. Crypto and Digital Wallets

Identity verification is playing an increasingly important role in the cryptocurrency ecosystem. As the industry evolves, exchanges and wallet providers are opting for advanced identity verification solutions to meet regulatory requirements, prevent fraud, and protect users from account takeovers. Whether it’s onboarding new users, recovering lost access, or monitoring high-value transactions, verifying identity adds a layer of trust without compromising the decentralized nature of crypto platforms.

3. Healthcare

In healthcare, verifying patient identity is crucial for protecting medical records, preventing insurance fraud, and ensuring accurate treatment. Hospitals and telehealth providers use identity verification to confirm patients before consultations or granting access to health portals.

This becomes even more important in remote services where doctors rely on digital systems to share sensitive records or prescribe medication.

4. E-commerce and Marketplaces

Online retailers and peer-to-peer marketplaces (like Airbnb, eBay, or Etsy) use identity verification to reduce fraud and build trust among users. Verifying sellers and buyers ensures transparency and accountability in transactions.

It also protects businesses from chargebacks, fake listings, and account takeovers.

5. Gaming and Gambling

In the online gaming and betting world, verifying user age and location is not just good practice, it’s a legal requirement. Identity verification ensures players meet age limits and reside in jurisdictions where gambling is allowed.

It also helps prevent identity fraud, multiple account abuse, and bonus exploitation.

6. Hospitality and Hotels

Hotels and short-term rental platforms are adopting digital identity verification to verify guests during booking and check-in. It reduces the risk of fraudulent bookings, enhances safety, and improves operational efficiency, especially in self-service environments like contactless check-ins.

For international travelers, this also enables smoother identity validation without manual document inspection.

7. Education and EdTech

Online learning platforms use identity verification to ensure that the right student is attending classes, completing assessments, and receiving certifications. With remote proctoring and biometric authentication, academic integrity is better maintained.

This is especially valuable in high-stakes environments like university admissions, online degrees, and professional certification exams.

8. Government Services

From issuing digital IDs and passports to voter registrations and benefit disbursement, governments worldwide are embracing identity verification for public services. Digital identity infrastructure ensures faster, more inclusive service delivery.

Many governments are also adopting biometric IDs and blockchain-based identity systems to improve transparency and reduce fraud.

Benefits of a Robust Identity Verification System

A well-designed identity verification system can unlock powerful advantages for both businesses and end-users. Below are some of its core benefits:

1. Enhanced Security

Verification ensures that only authorized individuals gain access to systems, services, or sensitive data. It’s a vital defense against phishing, account takeovers, and data breaches.

By combining biometrics with real-time risk analysis, organizations can block fraudulent access without slowing down legitimate users.

2. Streamlined Onboarding

Digital identity verification makes onboarding faster and more user-friendly. Instead of visiting a physical location with paperwork, users can verify their identity with a few taps on their phone.

This improves customer satisfaction, reduces drop-off rates, and lowers operational costs.

3. Regulatory Compliance

Meeting regulatory standards like KYC, AML, and GDPR is easier with automated verification. It ensures accurate record-keeping, audit readiness, and risk assessment.

Businesses can confidently expand to new markets without falling afoul of regional regulations.

4. Fraud Reduction

By verifying identity at every touchpoint, from account creation to transactions, fraudsters are kept at bay. It deters fake identities, synthetic fraud, and account takeovers.

As a result, businesses save on fraud losses, chargebacks, and manual reviews.

5. Improved Customer Trust

When users know their data is safe and that everyone on the platform is verified, it boosts confidence. This trust translates into higher engagement, loyalty, and referrals.

Curious how leading businesses put these benefits into practice? We break it down in this article.

Challenges in Identity Verification

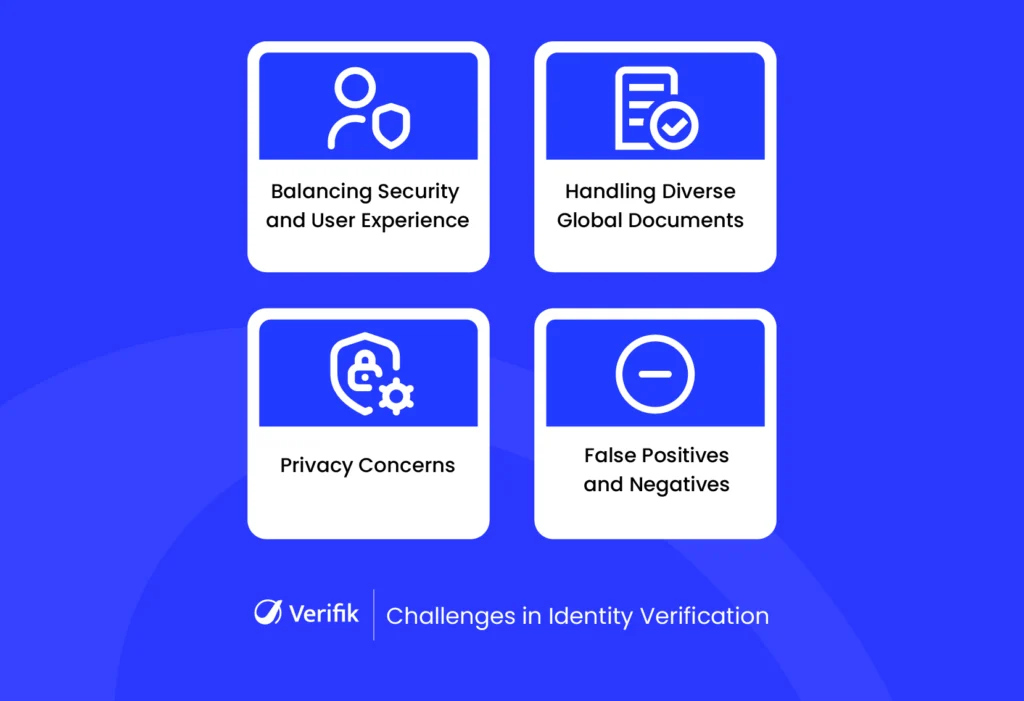

As effective as identity verification is, it’s not without its challenges. Here are a few hurdles businesses often face:

1. Balancing Security and User Experience

Too many security steps can frustrate users, leading to higher churn. But cutting corners on verification can compromise safety. The key is finding the sweet spot between robust security and smooth user experience.

Techniques like passive verification, facial liveness detection, and adaptive risk scoring help strike this balance.

2. Handling Diverse Global Documents

With hundreds of ID formats worldwide, such as different languages, layouts, and security features, automated systems must be trained to recognize and validate them all. This can be complex and resource-intensive.

Global document libraries, machine learning, and partnerships with data providers are helping improve accuracy.

3. Privacy Concerns

Storing sensitive data like biometrics or ID scans brings privacy risks. Businesses must adopt privacy-first architectures, encryption, and secure storage to protect user data.

Zero-knowledge verification and decentralized identity models are emerging as solutions that enhance privacy while maintaining security.

4. False Positives and Negatives

Automated systems can occasionally make errors, such as flagging legitimate users or approving fraudulent ones. This affects trust and requires manual intervention.

Continuous model training, human-in-the-loop review, and feedback loops are crucial for minimizing these errors.

You can read more about these challenges in our dedicated blog: 7 Biggest Identity Verification Challenges Businesses Face.

Future Trends in Identity Verification

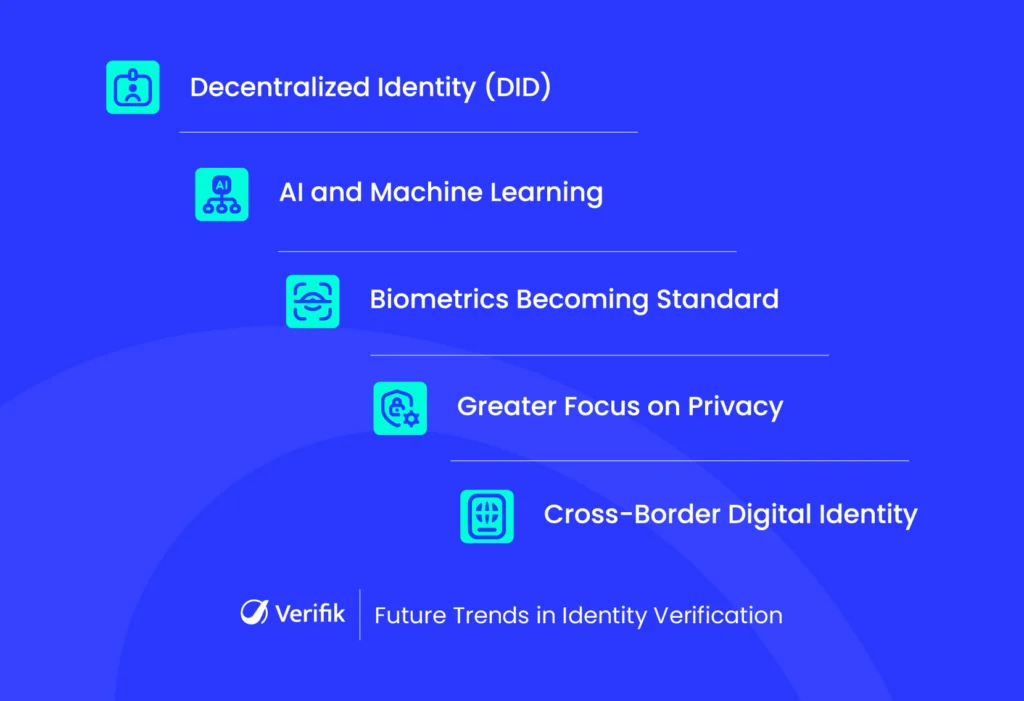

As identity tech evolves, several key trends are shaping its future:

1. Decentralized Identity (DID)

Users control their identity through self-sovereign IDs stored on blockchain. They can share only the necessary information without revealing everything. It’s more private, secure, and puts users in charge.

Governments and private sectors are experimenting with DIDs for digital passports, age verification, and health credentials.

2. AI and Machine Learning

AI is revolutionizing document scanning, facial matching, and anomaly detection. It helps reduce fraud, improve verification accuracy, and scale systems to handle global demand.

With deep learning models, verification can adapt to new fraud patterns and language variations in real time.

3. Biometrics Becoming Standard

Fingerprint and facial recognition are quickly replacing passwords. As mobile devices and webcams improve, biometrics will become the default way people verify themselves.

Expect to see iris scanning, voiceprint recognition, and behavioral biometrics gain traction.

4. Greater Focus on Privacy

With increasing regulations and user expectations, privacy-first verification methods, like zero-knowledge proofs, are being prioritized. Organizations will need to adopt verification solutions that align with global privacy standards like GDPR, HIPAA, and CPRA.

5. Cross-Border Digital Identity

As businesses expand globally, there’s growing demand for interoperable digital identities. Initiatives like eIDAS in the EU aim to create standardized digital ID frameworks that work across borders.

This will simplify identity verification in travel, cross-border e-commerce, and international hiring.

Final Thoughts

Identity verification is more than just a step in the onboarding flow, it’s a foundation of digital trust. From reducing fraud and ensuring compliance to improving user experience and expanding access, its impact is far-reaching.

As we move deeper into the digital age, the challenge will be to build systems that are not only secure and accurate, but also respectful of privacy and seamless for users. Whether you’re a startup, a global enterprise, or a public agency, investing in strong identity verification today is a step toward a more secure and trusted tomorrow.

Experience Secure Identity Verification with Verifik

As a trusted leader in identity verification, Verifik delivers cutting-edge cybersecurity solutions designed to prevent fraud and protect your business. Our advanced technologies include:

- Facial Recognition: Our advanced facial recognition technology securely verifies identities by analyzing unique facial features, ensuring only authorized users can access your platform.

- ID Document Validation: Real-time document verification, including passports, driver’s licenses, and national IDs, helps prevent fraud by detecting altered or fake documents.

- Passwordless Logins: Our passwordless login solutions reduce the risk of identity theft by enabling secure access using text messages, WhatsApp, or facial recognition instead of passwords.

- Document Scanning: Effortlessly scan and upload documents securely from any device, making the identity verification process faster and more efficient.

Contact us today for a free demo and discover how Verifik’s identity verification solutions can safeguard your business against fraud!