Every business that interacts with new users faces a critical decision: how to verify who’s on the other side of the screen. Whether you’re running a fintech platform, an e-commerce store, or a SaaS business, failing to verify identities can lead to serious consequences. Without a robust identity verification system in place, your business is vulnerable to fraud, regulatory fines, and even reputational damage.

In this blog, we’ll explore the top business benefits of using an identity verification platform and why it’s an essential investment for companies that want to scale securely.

What Is an Identity Verification Platform?

An identity verification platform is a digital solution that helps businesses confirm whether a person is who they claim to be. It uses a combination of technologies, including:

- Document verification (e.g., passports, ID cards)

- Biometric checks (e.g., facial recognition, fingerprint scanning)

- Database screening (e.g., watchlists, credit bureaus, government records)

Rather than relying on time-consuming and error-prone manual reviews, businesses can now automate user verification through APIs or software integrations. The result is faster onboarding, better fraud prevention, and smoother compliance.

What’s changing now is how these identity verification platforms prioritize privacy alongside security. Thanks to breakthroughs like ZK Face Proofs, a simple facial scan can now verify users instantly without ever exposing or storing their sensitive biometric data. It’s a game-changer for companies that want to stay compliant and build trust, without compromising on user privacy.

Why Identity Verification Matters More Than Ever

1. Fraud Is Evolving

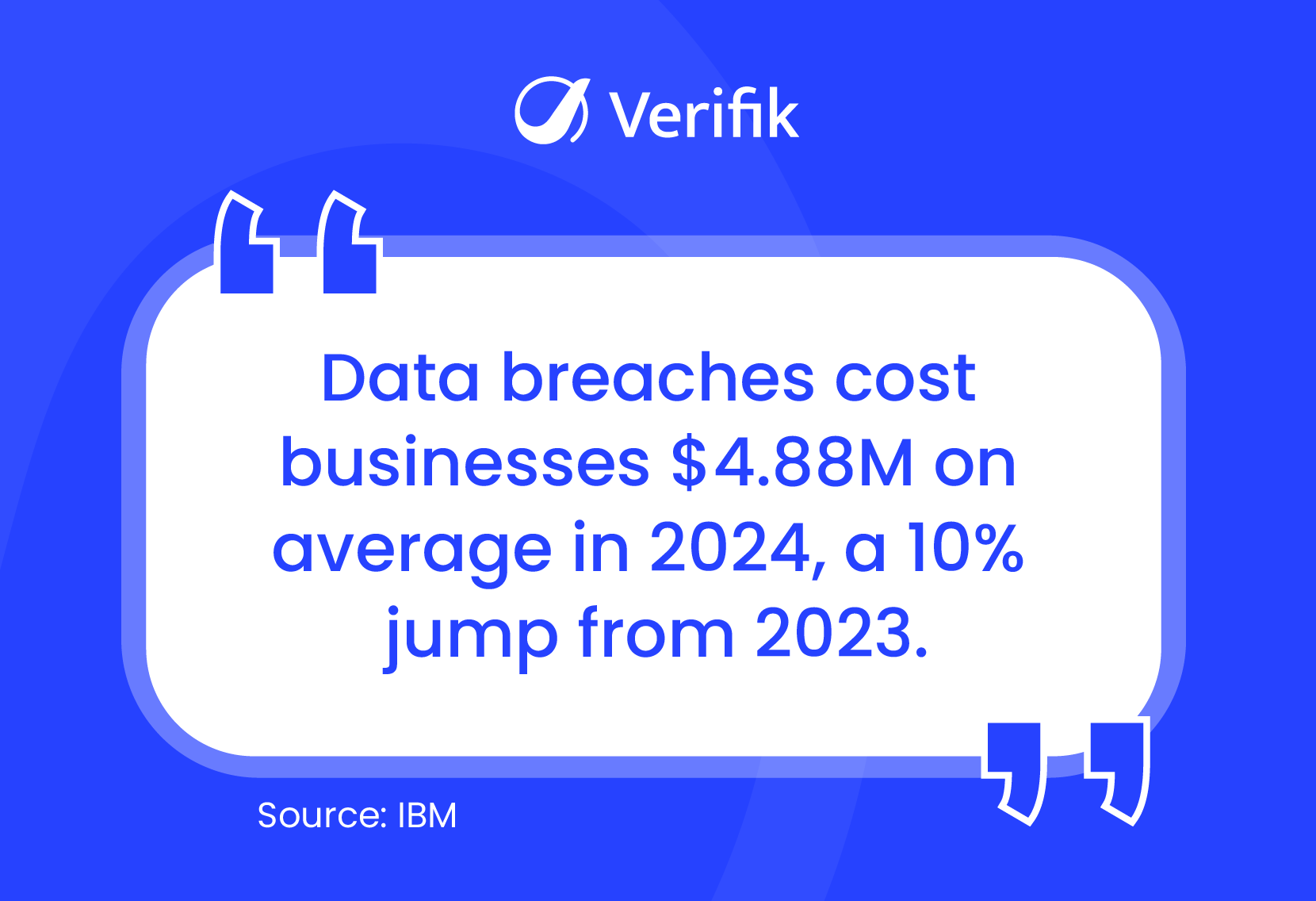

Fraud costs businesses over $5 trillion globally each year. Sophisticated fraud techniques, like deepfake IDs, phishing schemes, and synthetic identities, are becoming more common. Cybercriminals are using automation, AI-generated documents, and social engineering to bypass traditional checks. Businesses need a way to proactively detect and block fraud before it escalates into breaches or financial losses.

2. Regulatory Pressure Is Mounting

From KYC (Know Your Customer) to AML (Anti-Money Laundering) to GDPR and CCPA, companies are under immense pressure to comply with local and international regulations. Non-compliance can result in heavy fines, legal action, and even the loss of licenses. Identity verification platforms help businesses remain compliant by embedding regulatory workflows directly into the onboarding process.

3. Customer Trust Is Fragile

A single incident of identity theft or misuse can break customer trust permanently. In industries handling sensitive data or financial transactions, even the perception of weak security can lead to customer churn. Verifying identity securely not only protects users, it signals that your business takes privacy and safety seriously.

Key Business Benefits of Identity Verification Platforms

1. Fraud Prevention at Scale

A key advantage of using a robust identity verification platform is its ability to help businesses prevent fraud before it happens. Identity verification platforms use AI and machine learning to detect unusual patterns, block fake IDs, and flag high-risk behavior instantly. They analyze data points like geolocation, IP addresses, device fingerprinting, and behavior analytics to distinguish real users from bad actors. This reduces the risk of account takeovers, chargebacks, bonus abuse, fake registrations, and data breaches to save businesses from massive financial losses and reputational harm.

2. Built-In Regulatory Compliance

Staying compliant with global regulations is complex, especially if you operate in multiple regions. Identity verification platforms automate KYC/AML workflows, verify documents against trusted databases, monitor ongoing user behavior for red flags, and track audit trails for regulatory reporting. Many platforms offer updates for local regulation changes, which allows businesses to stay ahead without needing legal expertise in-house.

3. Faster, Smoother Onboarding

Manual ID checks are not only time-consuming, they frustrate users and lead to drop-offs. With real-time user verification in seconds, identity verification platforms help businesses onboard more customers with less friction and higher conversion rates. This is especially critical for industries like fintech or e-commerce, where customers expect instant access and any delay can cause them to abandon the process.

4. Better User Trust and Brand Protection

When customers see that your platform uses secure and modern verification methods, it instills confidence. Displaying trust badges or explaining your verification process can help increase transparency and show users that you care about their security. As trust grows, so does loyalty, and businesses that demonstrate responsibility tend to have stronger brand equity.

5. Operational Efficiency and Cost Savings

Identity verification platforms automate time-heavy processes like document review, duplicate checking, and compliance logging. This reduces the need for large verification teams, minimizes human error, and cuts down operational costs without compromising accuracy. It also frees up staff to focus on more strategic initiatives like fraud analysis and customer experience.

6. Scalability Across Borders

If you’re growing internationally, you’ll need to verify users with different languages, document types, and regulations. Modern Identity verification platforms are built to scale globally by offering support for multiple languages, regional ID types (passports, national IDs, licenses), and regulatory frameworks. This ensures your onboarding process remains efficient and compliant in every new market you enter.

7. Insightful Analytics for Risk Strategy

These platforms don’t just verify users, they generate valuable data. Businesses can gain insights into verification failures, fraud trends, user demographics, device types, and regional risks. This intelligence helps refine your fraud prevention strategies over time, prioritize high-risk areas, and improve overall risk management posture.

Final Words

Fraud is growing smarter, and businesses need to grow smarter, too. Identity verification platforms help you protect your customers, meet regulatory requirements, and build a foundation of trust and security. From cutting costs and improving efficiency to safeguarding your reputation, the benefits are too powerful to ignore.

One Platform. Every Verification You Need. Verifik.

Verifik centralizes all your identity verification needs into one intelligent platform, trusted by fintechs, healthcare providers, e-commerce brands, and governments alike. Our privacy-first approach keeps you compliant while protecting user data with zero-knowledge encryption.

Want to explore how Verifik can support your security goals? Talk to our team now!