Every digital interaction starts with a question: Can we trust this user? For businesses, answering that question accurately is critical. Identity verification has become the foundation of secure onboarding, fraud prevention, and regulatory compliance, especially in industries handling sensitive data or financial transactions.

But as fraud tactics grow more advanced and compliance demands increase, verifying identities has become more complex. Businesses must now detect fake identities, prevent account takeovers, and meet global regulations, all without disrupting the user experience.

This blog explores the 7 biggest identity verification challenges businesses face and the steps they can take to overcome each one with confidence.

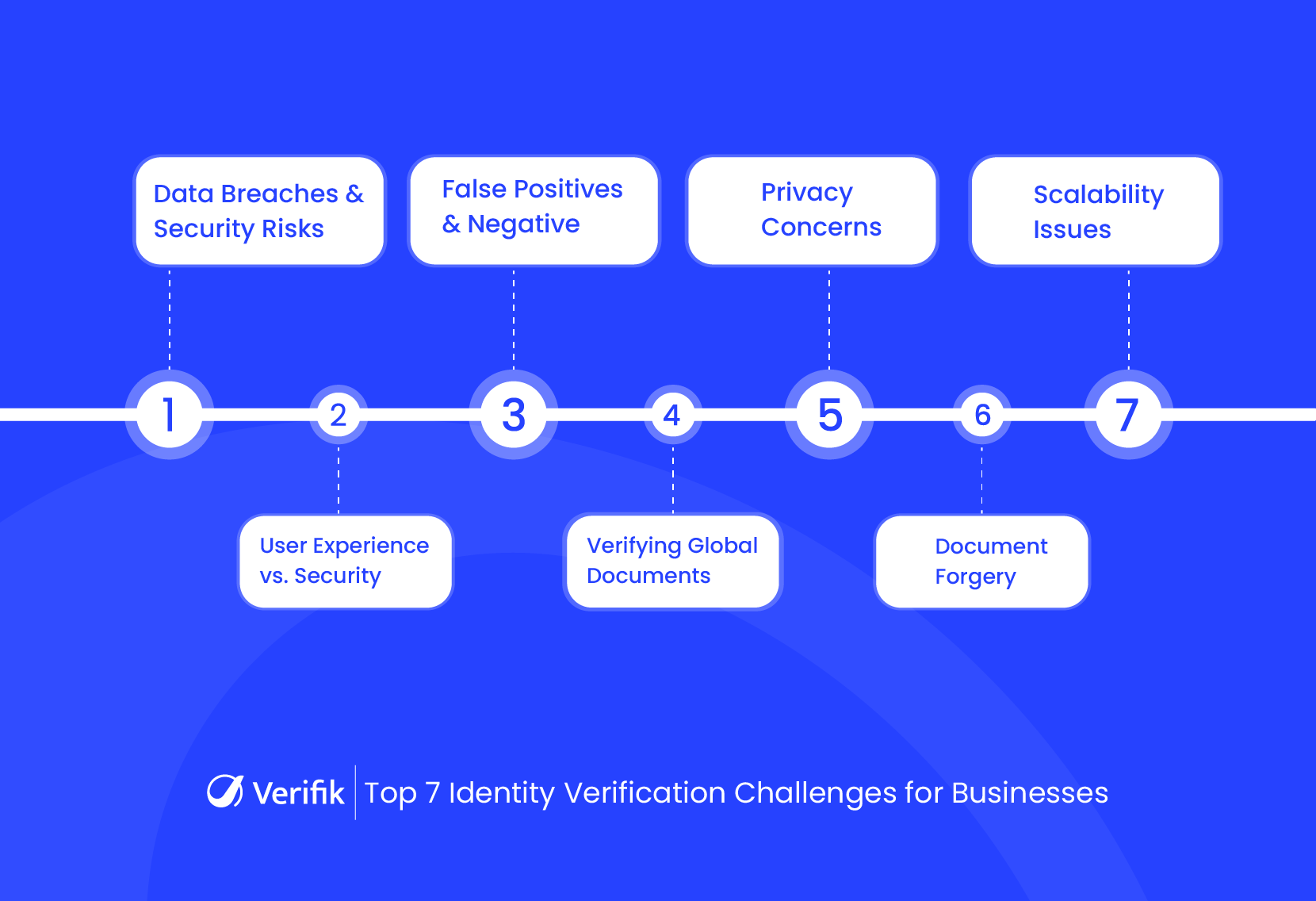

1. Data Breaches and Security Risks

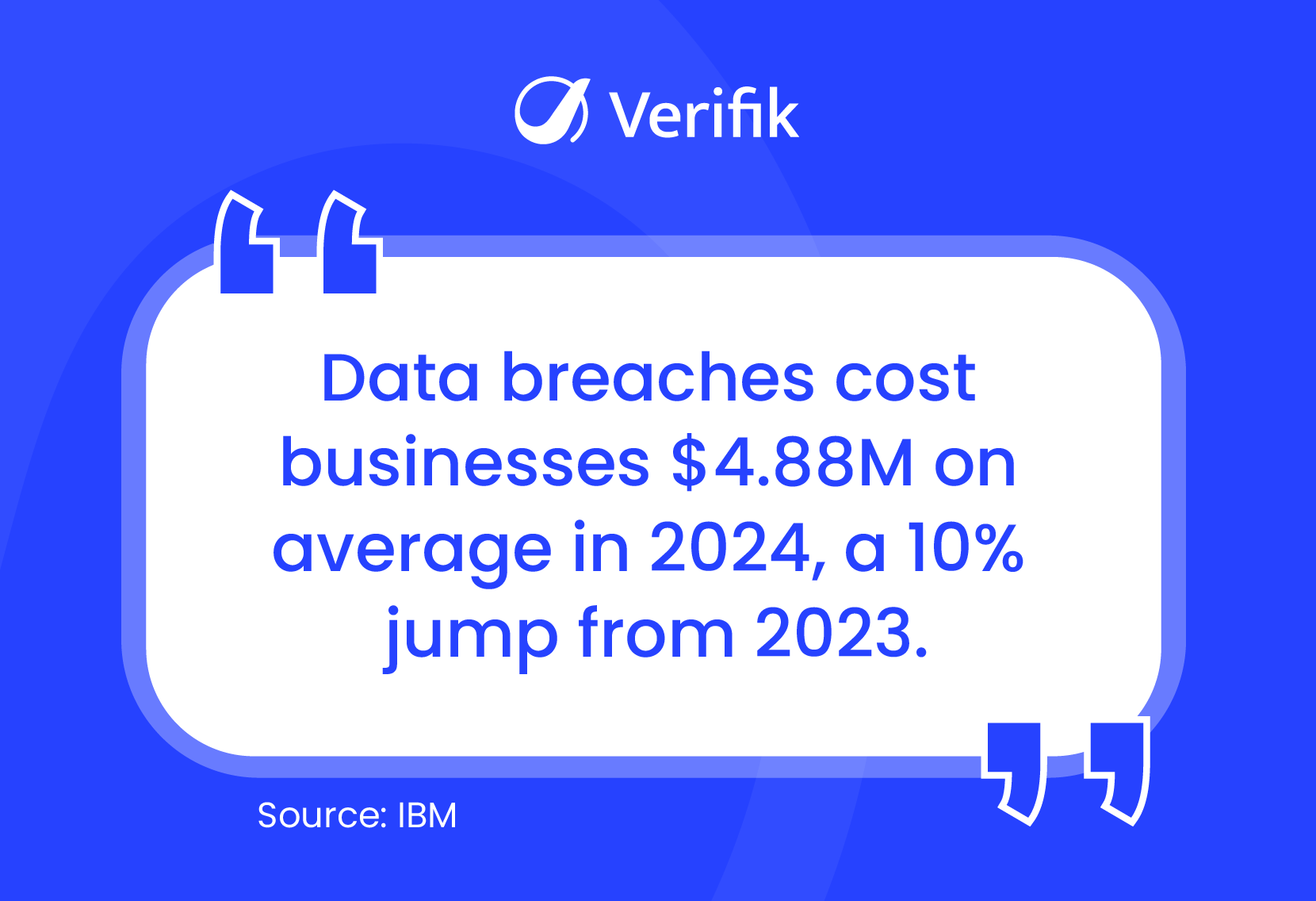

One of the most significant concerns in identity verification is the risk of exposing personally identifiable information (PII). Storing sensitive data like ID numbers, biometrics, and documents makes companies prime targets for cybercriminals. A single breach can lead to regulatory fines, class-action lawsuits, and irreversible reputational damage.

In 2024, the global average cost of a data breach rose to USD 4.88 million, marking a 10% increase from the previous year and setting a new all-time high. This sharp rise highlights the severe financial impact a single breach can have on any organization, especially those handling sensitive identity data.

The fix? Businesses need to move beyond traditional databases and adopt secure-by-design solutions. Privacy-first identity verification technologies like Zero-Knowledge Proofs (ZKPs) and ZK Face Proof allow users to authenticate their identity without ever revealing or storing sensitive data. This reduces exposure and gives users more control over their personal information.

2. Balancing User Experience with Security

Customers today expect fast and hassle-free experiences, especially during onboarding. But many verification processes are slow, repetitive, or overly technical, leading to user frustration and high abandonment rates. This is particularly damaging in industries like fintech and eCommerce, where the first impression can make or break customer retention.

The fix? Use identity verification solutions that offer a frictionless user experience while maintaining strong security. For example, platforms like smartENROLL enable biometric-based onboarding that’s both quick and highly secure. The goal is to make verification feel like part of the experience, not a barrier to it.

3. False Positives and False Negatives

Mistakenly flagging legitimate users as fraudsters (false positives) can cost you customers. Conversely, approving bad actors (false negatives) opens the door to fraud and regulatory risks. Striking the right balance is one of the hardest technical challenges in identity verification.

The fix? Leverage AI-driven identity verification that learns from patterns and improves accuracy over time. Modern identity verification solutions combine facial recognition, liveness detection, and document scanning to drastically reduce both types of errors and ensure trust without friction.

4. Handling Diverse Global Documents

Businesses operating globally often face the challenge of verifying a wide variety of documents from different countries, each with its own language, format, and security features. This complexity increases the risk of misidentification and slows down the verification process.

The fix? Invest in identity verification solutions that support a vast library of global documents and offer multilingual OCR (Optical Character Recognition) capabilities. Their AI-powered algorithms trained on region-specific data can detect subtle document patterns and anomalies to help differentiate authentic documents from sophisticated forgeries. This ensures smooth onboarding for international users without sacrificing accuracy or speed.

5. Privacy Concerns

With data privacy in the spotlight, users are increasingly aware of how their information is handled. Collecting biometric data, IDs, or other sensitive details without clear justification can create distrust and raise legal red flags, especially under regulations like GDPR, CCPA, and other regional data protection laws. Beyond compliance, businesses risk losing customer loyalty if privacy isn’t transparently protected.

The fix? Embed privacy into the design of your identity verification process from day one. Use technologies like Zero-Knowledge Proofs (ZKPs) or ZK Face Proof that authenticate users without storing or exposing their private information. This eliminates the need for centralized data storage, hence reducing the risk of breaches while giving users full control over their identity data. Also, make your privacy policies clear and accessible to build trust with both users and regulators.

6. Fraudulent Document Forgery

Fake IDs and forged documents are a common tactic used by fraudsters to bypass identity verification processes. Businesses need to have systems in place to detect and reject forged documents, which can be challenging due to the increasing sophistication of counterfeiters.

The fix? Rely on document verification technologies that analyze physical features like watermarks, holograms, and unique security patterns can help detect forged documents. Additionally, integrating AI-based systems that cross-check user information with multiple sources can further reduce the risk of fraud.

7. Scalability of Verification Systems

As businesses grow, so do their identity verification needs. What works for a small startup may not be efficient or scalable for a larger enterprise, especially when dealing with thousands or even millions of users. Ensuring that your identity verification system can scale with your business is crucial for long-term success. A system that breaks under pressure can choke your growth pipeline.

The fix? Choose identity verification platforms that are cloud-native and designed for scale. These systems can process thousands of verifications simultaneously without compromising speed or accuracy. Bonus points if they offer real-time analytics to help you adapt quickly.

Final Words

Identity verification is no longer a simple process of checking a user’s ID. With the rise in cybercrime, regulatory requirements, and the need for seamless user experiences, businesses face numerous challenges in securing their digital platforms. By investing in advanced identity verification systems that prioritize security, compliance, and user experience, companies can mitigate these challenges while safeguarding their data and reputation.

Ready to Overcome Identity Verification Challenges?

At Verifik, we provide cutting-edge solutions to help your business tackle the toughest identity verification challenges: securely, seamlessly, and at scale. Whether you’re dealing with data breaches, fraud prevention, or compliance, our technologies, like ZK Face Proof, smartENROLL, and smartACCESS are designed to protect your users and your brand.

Want to see our technologies in action? Schedule a free demo today!