The way you welcome new customers sets the tone for their entire journey with your business. A smooth and secure onboarding process builds trust, while a slow or complicated one can push people away before they even get started. That is why many organizations are turning to digital onboarding solutions. These tools make it possible to verify identities, meet compliance requirements, and bring customers on board quickly and safely. The challenge, however, lies in choosing the right solution that not only protects your business but also delivers a positive experience for your customers.

In this blog, we will explore what a digital onboarding solution is, why choosing the right one matters, and the key factors you should consider before making your decision.

What is a Digital Onboarding Solution?

A digital onboarding solution is a platform that helps organizations verify and register new users entirely online. Instead of relying on paperwork or face-to-face checks, it enables secure identity verification, biometric authentication, database screening, and compliance checks in real time.

These solutions are widely used across industries like:

- Banking & Fintech: Seamless account opening and KYC compliance.

- Telecom: Quick SIM registration and fraud prevention.

- Gaming & Casinos: Age verification and regulatory adherence.

- E-commerce & BNPL: Secure onboarding of buyers and merchants.

By leveraging a digital onboarding solution, organizations make registration simple, secure, and reliable from the first interaction.

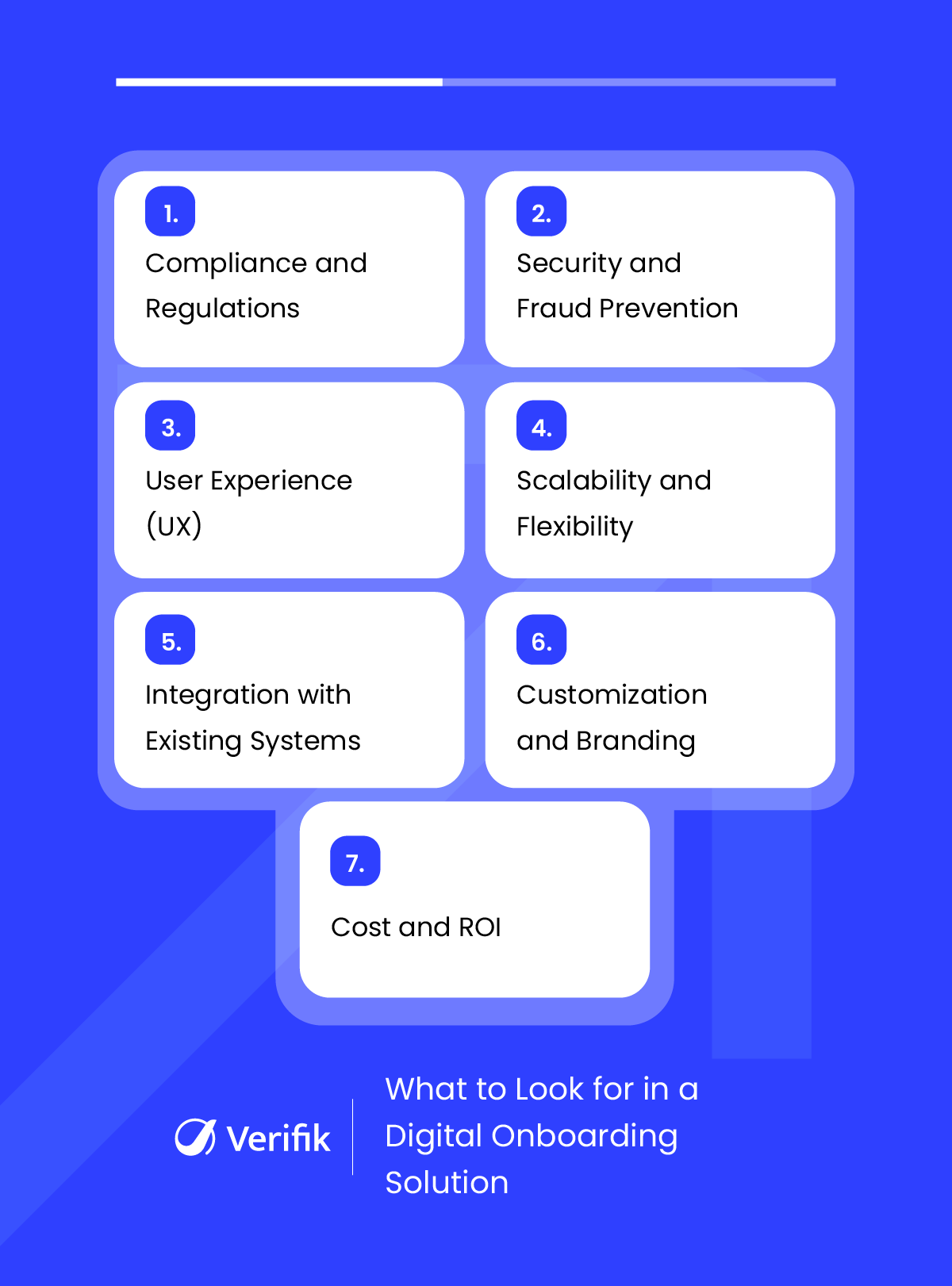

Key Factors to Consider When Choosing a Digital Onboarding Solution

An effective digital onboarding platform goes beyond technology. It must balance security, compliance, user experience, and scalability. Consider the following factors before making your choice.

1. Compliance and Regulations

Compliance is not optional. Every business that deals with customer data, especially in regulated industries like finance, telecom, or gaming, must meet strict legal requirements. The right solution should:

- Support KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to prevent financial crime.

- Align with GDPR and global data protection laws to safeguard sensitive information.

- Offer compliance updates as regulations evolve, so your business never lags behind.

A provider that fails in compliance can put your company at risk of fines, license suspensions, and reputational damage. Choosing a solution that places compliance at its core keeps both your business and your customers safe.

2. Security and Fraud Prevention

Security is the heart of digital onboarding. The solution you choose should go beyond basic ID checks and actively block fraud before it happens. Look for features such as:

- Biometric authentication such as face recognition, fingerprint, or voice verification to verify users accurately.

- Liveness detection to prevent spoofing through photos, deepfakes, or stolen IDs.

- Document verification with advanced OCR to detect tampered or forged documents.

- Database screening against sanctions, watchlists, and politically exposed persons (PEPs).

A secure onboarding solution not only protects your business from fraud but also builds customer trust.

3. User Experience (UX)

Even the most secure system fails if customers abandon it out of frustration. A successful digital onboarding solution must strike a balance between security and convenience. Key aspects include:

- Mobile-first design: Customers should complete onboarding easily from smartphones, without technical hurdles.

- Speed: Verification should take seconds, not minutes. Long waiting times directly increase drop-offs.

- Accessibility: Support for multiple languages and regions, along with simple interfaces, ensures inclusivity.

A streamlined UX means customers spend less time worrying about forms and more time engaging with your services.

4. Scalability and Flexibility

Your onboarding solution should grow with your business. Whether you need to process a few hundred sign-ups per week or tens of thousands per day, the system must deliver consistent performance.

Flexibility is equally important. The platform should adapt to:

- Different industries and use cases (banking, gaming, e-commerce, telecom).

- Regional regulations across markets.

- Multiple languages and document types to serve a global customer base.

A scalable onboarding solution ensures you’re ready for expansion without having to switch providers later.

5. Integration with Existing Systems

Your digital onboarding platform should work smoothly with the tools you already use. It should connect effortlessly with your CRM, ERP, core banking, or payment systems through easy-to-deploy APIs.

When integration is smooth, data flows across departments without duplication or errors, which gives teams a single and accurate view of each customer. This saves time, supports compliance, and ensures your onboarding process delivers value without disrupting established operations. A well-integrated platform also makes it easier to scale your onboarding process and add new tools or services as your business grows.

6. Customization and Branding

Onboarding is part of your brand experience, so consistency matters. A rigid, one-size-fits-all solution won’t meet your needs. Instead, prioritize the digital onboarding solution that offers:

- White-labeling options so the entire process reflects your brand identity.

- Customizable workflows that allow you to design journeys tailored to your customers.

- Adaptive verification levels, where low-risk users go through quick checks while high-risk cases undergo deeper scrutiny.

Customization ensures your onboarding is not only secure but also aligned with how you want customers to experience your business.

7. Cost and ROI

Price should never be the only factor when choosing a solution, but it’s always part of the equation. A smart decision balances cost against long-term value. Consider:

- Flexible pricing models such as pay-per-verification, per-user, or subscription-based plans.

- Operational savings from reduced fraud, fewer manual checks, and faster customer acquisition.

- Return on investment (ROI), where a slightly higher upfront cost may lead to lower fraud losses, better conversions, and higher retention.

In short, the cheapest option often costs more in the long run, while the right solution pays for itself through efficiency and customer trust.

Conclusion and How smartENROLL Can Help

Choosing the right digital onboarding solution is more than a technology decision. It impacts customer trust, operational efficiency, compliance, and business growth. A platform that balances security, user experience, scalability, and integration can turn onboarding from a challenge into a competitive advantage.

smartENROLL by Verifik is designed to make this process seamless. It offers biometric verification, document authentication, real-time KYC checks, and database screening across global watchlists to ensure onboarding is fast, secure, and fully compliant. Its easy-to-deploy APIs allow smooth integration with your existing systems, while its scalable architecture supports growth across industries and regions.

Book your free 30-minute demo of smartENROLL today and see how it can transform your onboarding process.