In the world of financial services, compliance is more than a requirement, it’s a responsibility. Two of the most important pillars in this space are KYC (Know Your Customer) and AML (Anti-Money Laundering). Both serve critical roles in fighting financial crimes, but they are often misunderstood or used interchangeably.

In this blog, we’ll break down the clear differences between KYC and AML, explain how they work together, and why businesses must prioritize both.

What is KYC (Know Your Customer)?

KYC, short for Know Your Customer, refers to the processes businesses use to verify the identity of their clients. It is a legal and regulatory requirement in many jurisdictions across the globe, designed to prevent illegal activities like identity theft, money laundering, terrorist financing, and fraud.

When a business onboards a new customer, KYC ensures they know who they are dealing with and that the customer is who they claim to be.

KYC typically includes:

- Identity Verification: Collecting and validating official documents (e.g., passport, driver’s license, national ID card).

- Address Verification: Confirming the customer’s place of residence via utility bills, bank statements, or similar documents.

- Biometric Verification: Verifying a selfie, video, or live facial scan against submitted ID documents.

The goal is to create a reliable customer profile that informs future interactions and monitoring.

Key Components of a KYC Process

- Customer Identification Program (CIP):

This is the initial step and includes collecting documents and information to verify a customer’s identity. - Customer Due Diligence (CDD):

This involves evaluating the customer’s background to understand the risk they pose. Low-risk individuals undergo standard CDD, while high-risk individuals require deeper checks. - Enhanced Due Diligence (EDD):

If a customer is deemed high-risk (e.g., they operate in a high-risk industry or are linked to high-risk countries), businesses must collect additional information and monitor them more closely.

Examples of KYC in Action

- Banks requesting identification before opening an account.

- Cryptocurrency exchanges requiring ID verification for wallet creation.

- Telecom companies verifying identity before issuing SIM cards.

KYC is typically performed during customer onboarding, but responsible businesses also refresh KYC data periodically, especially for higher-risk customers. The goal of KYC processes is to help businesses build a reliable customer base while minimizing exposure to risks related to financial crimes.

What is AML (Anti-Money Laundering)?

AML, or Anti-Money Laundering, encompasses a broader set of procedures, laws, and regulations aimed at identifying, preventing, and reporting suspicious financial activities that could involve money laundering or other criminal conduct.

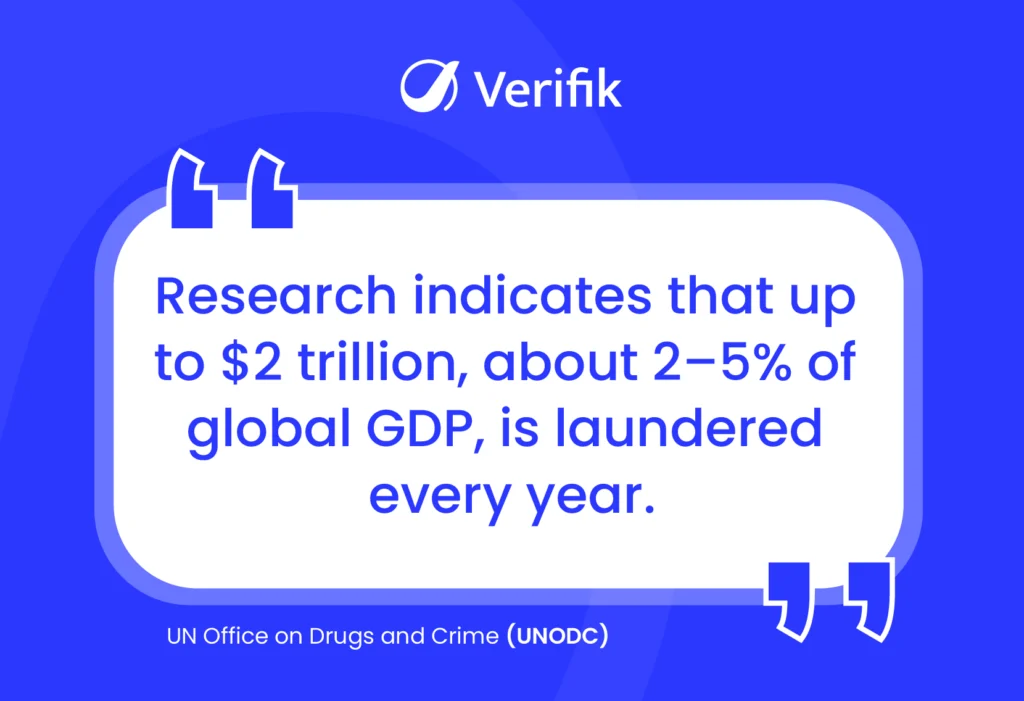

Money laundering is not a small problem. According to the UNDC, around $2 trillion is laundered globally every year, a staggering amount that represents up to 5% of the world’s GDP. This highlights the massive scale and impact of financial crime on the global economy.

Money laundering typically involves three stages:

- Placement: Introducing illegally obtained money into the financial system.

- Layering: Moving the money through various transactions to obscure its origins.

- Integration: Reintroducing the laundered money into the economy as apparently legitimate funds.

AML systems are designed to spot these patterns through continuous monitoring of financial activities, transaction histories, and customer behaviors.

Key Components of AML

- Transaction Monitoring: Analyzing customer transactions to identify unusual patterns or red flags.

- Suspicious Activity Reports (SARs): Filing reports when suspicious behavior is detected, such as unusually large transactions or inconsistent account activity.

- Record Keeping: Maintaining comprehensive records of transactions and customer interactions for regulatory review.

- Risk Assessment: Ongoing evaluation of clients’ risk profiles based on transaction behavior, geopolitical developments, and changes in business activities.

Examples of AML in Action

- A financial institution automatically flagging and investigating a large international wire transfer that doesn’t align with a customer’s normal activity.

- A casino monitoring and reporting unusually high cash purchases made by a new customer.

AML ensures that businesses not only screen customers at the start but also keep a close watch on their activities throughout the customer lifecycle.

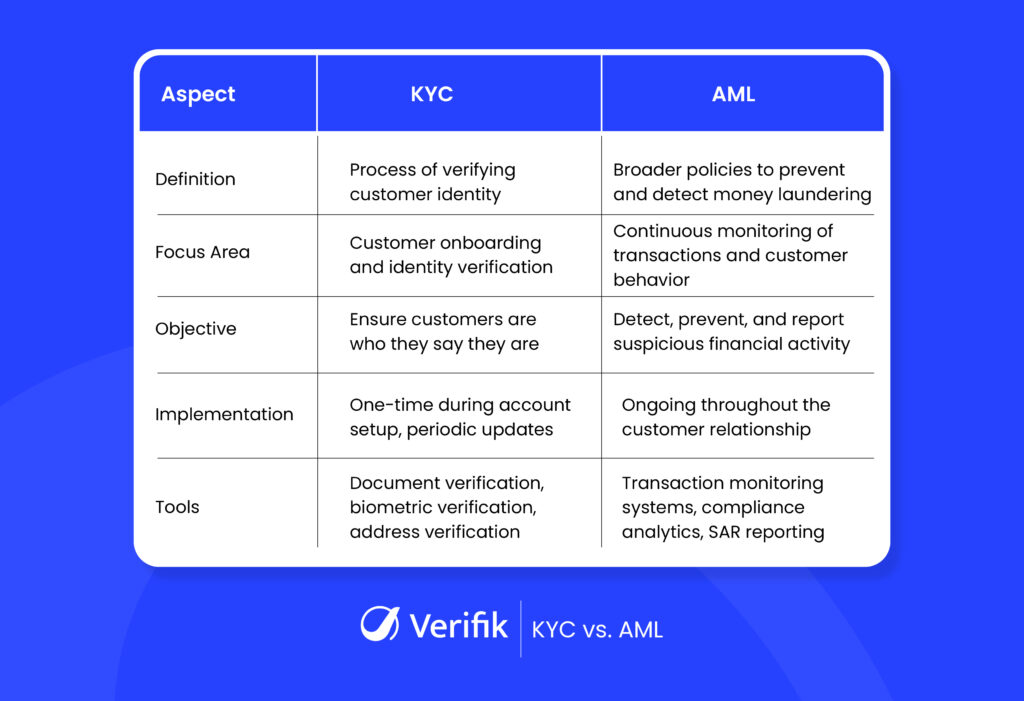

Key Differences Between KYC and AML

Although KYC and AML are closely connected, they differ in scope, purpose, and application. Here’s a detailed comparison:

Quick Summary:

- KYC is part of AML compliance.

- KYC is about who the customer is.

- AML is about what the customer is doing (and ensuring it’s legal).

In other words, KYC lays the groundwork, and AML ensures ongoing vigilance.

How KYC and AML Work Together

While KYC and AML have different functions, they are two sides of the same coin. In fact, effective AML compliance depends heavily on robust KYC practices.

KYC is the foundation:

- If you onboard the wrong customers, even the best AML system won’t save you.

- Proper identification and verification at the beginning ensure you know the risk level of each customer.

AML builds on KYC:

- Once the customer is onboarded, AML practices come into play by continuously monitoring the customer’s transactions and behavior.

- If a customer’s behavior deviates from their known profile, it triggers AML alerts.

Together, KYC and AML ensure a full lifecycle approach to compliance, from the first point of contact to ongoing monitoring.

Regulatory Frameworks Governing KYC and AML

Compliance is not optional, it’s legally enforced. Organizations are held to strict standards by regulators around the world.

Some of the major regulatory frameworks include:

- Financial Action Task Force (FATF):

Sets international standards for fighting money laundering and terrorist financing. - Bank Secrecy Act (BSA) – USA:

Requires financial institutions to assist government agencies in detecting and preventing money laundering. - European Union’s Anti-Money Laundering Directives (AMLDs):

Ongoing series of regulations setting AML and KYC standards for EU member states. - FinCEN (Financial Crimes Enforcement Network):

The U.S. Treasury bureau responsible for safeguarding the financial system. - FCA (Financial Conduct Authority) – UK:

Oversees KYC and AML compliance in the UK’s financial services industry.

Non-compliance can result in heavy penalties. Major banks have faced fines in the billions of dollars for failures in KYC and AML practices.

Why Businesses Must Prioritize Both KYC and AML

Today’s regulatory environment leaves no room for error. Businesses that neglect KYC and AML compliance expose themselves to severe consequences:

-

Financial Penalties:

Regulatory agencies around the world are stepping up enforcement. Businesses found in violation of KYC and AML obligations can face staggering fines, often running into millions or even billions of dollars. These penalties don’t just hurt the balance sheet, they damage investor relations, cause stock prices to fall, and divert resources that could have been used for growth or innovation. In some cases, a single compliance failure can financially cripple a company beyond repair.

-

Operational Risk:

Without strong KYC and AML frameworks in place, businesses leave themselves exposed to fraud, theft, and financial crime. Criminals often target companies with weak verification and monitoring systems to move illicit funds, commit identity fraud, or perpetrate other illegal activities. This creates operational chaos, drains internal resources, increases cybersecurity vulnerabilities, and often leads to prolonged and expensive damage control efforts.

-

Reputational Damage:

Trust is one of the most valuable assets any business can have and it is incredibly fragile. Even one compliance failure can tarnish a company’s reputation among customers, partners, and investors. Media exposure, public outcry, and negative customer perception can trigger an irreversible loss of trust. In industries like finance, technology, and e-commerce, where customer loyalty is hard-won, reputational damage can be far more costly than any regulatory fine.

-

Regulatory Sanctions:

In addition to fines, businesses that fail to comply with KYC and AML regulations risk regulatory sanctions such as license suspensions, business restrictions, and even forced shutdowns. In some jurisdictions, executives and compliance officers can be held personally liable, facing criminal charges or lifetime bans from operating in regulated industries. Regulatory sanctions not only disrupt operations but can permanently limit a company’s ability to grow and expand into new markets.

Prioritizing KYC and AML not only fulfills regulatory obligations but also strengthens business resilience, customer trust, and long-term viability.

The Bottom Line: Mastering KYC and AML is Non-Negotiable

While KYC and AML are often mentioned together, they perform distinct but equally crucial roles in a strong compliance framework.

- KYC ensures you know who your customers are at the very beginning.

- AML ensures you continue to monitor what your customers are doing, spotting and stopping illegal activity before it damages your business.

Together, they form a powerful defense system that protects businesses, customers, and the financial system at large. Businesses that invest early in smarter KYC and AML practices not only shield themselves from penalties but also create safer, more reliable environments for their customers.

How Verifik Can Help

Verifik empowers businesses to manage KYC and AML requirements with greater speed, security, and accuracy. From facial recognition and document validation to passwordless authentication, we help businesses verify identities, detect fraud, and meet regulatory standards with confidence.

By partnering with Verifik, you can:

- Fast and reliable identity verification.

- Stronger protection against fraudulent accounts and activities.

- Seamless onboarding without compromising security.

- Compliance with KYC and AML regulations across industries.

Book your free demo with Verifik today and see how our technology can help you secure your business and earn customer trust from day one!