In a world where convenience drives user expectations, digital onboarding has become a game-changer for businesses that want to offer seamless, secure, and scalable customer experiences. Whether it’s opening a bank account, signing up for a telecom service, or verifying age for online gaming, digital onboarding simplifies the process while ensuring regulatory compliance.

In this blog, we break down what digital onboarding really means, how it works, the value it brings to businesses, and where it’s being used most effectively.

What is Digital Onboarding?

Digital onboarding refers to the fully digital and automated process of enrolling new users (customers, employees, or partners) into a company’s systems, products, or services. It uses tools like document scanning, facial recognition, e-signatures, and real-time data validation to complete the entire process digitally.

For businesses, it means faster customer acquisition, lower overhead, and compliance with regulations like KYC and AML. For users, it means signing up from anywhere, in minutes.

There are three common types of digital onboarding:

- Customer Onboarding: Used by banks, fintech apps, telecoms, and insurance providers

- Employee Onboarding: For verifying, enrolling, and giving access to new hires

- Vendor/partner Onboarding: To verify business identities, documents, and contracts

Curious how digital onboarding stacks up against traditional methods? Read our blog: Digital vs Traditional Onboarding: Key Differences and Which Wins.

Key Technologies Powering Digital Onboarding

Modern digital onboarding is powered by a mix of identity tech, AI, and security protocols:

- Facial Recognition: Matches user’s selfie with official ID photo

- Liveness Detection: Detects if user is a real person, not a spoof or video

- OCR (Optical Character Recognition): Extracts data from ID documents

- eSignatures: Legally binding contract sign-off without physical presence

- Zero-Knowledge Proofs: Enable identity verification without storing biometric data

- Blockchain: Secure audit trails for ID verification and data integrity

- AI & ML: Automate risk scoring, anomaly detection, and decision making

Key Benefits of Digital Onboarding

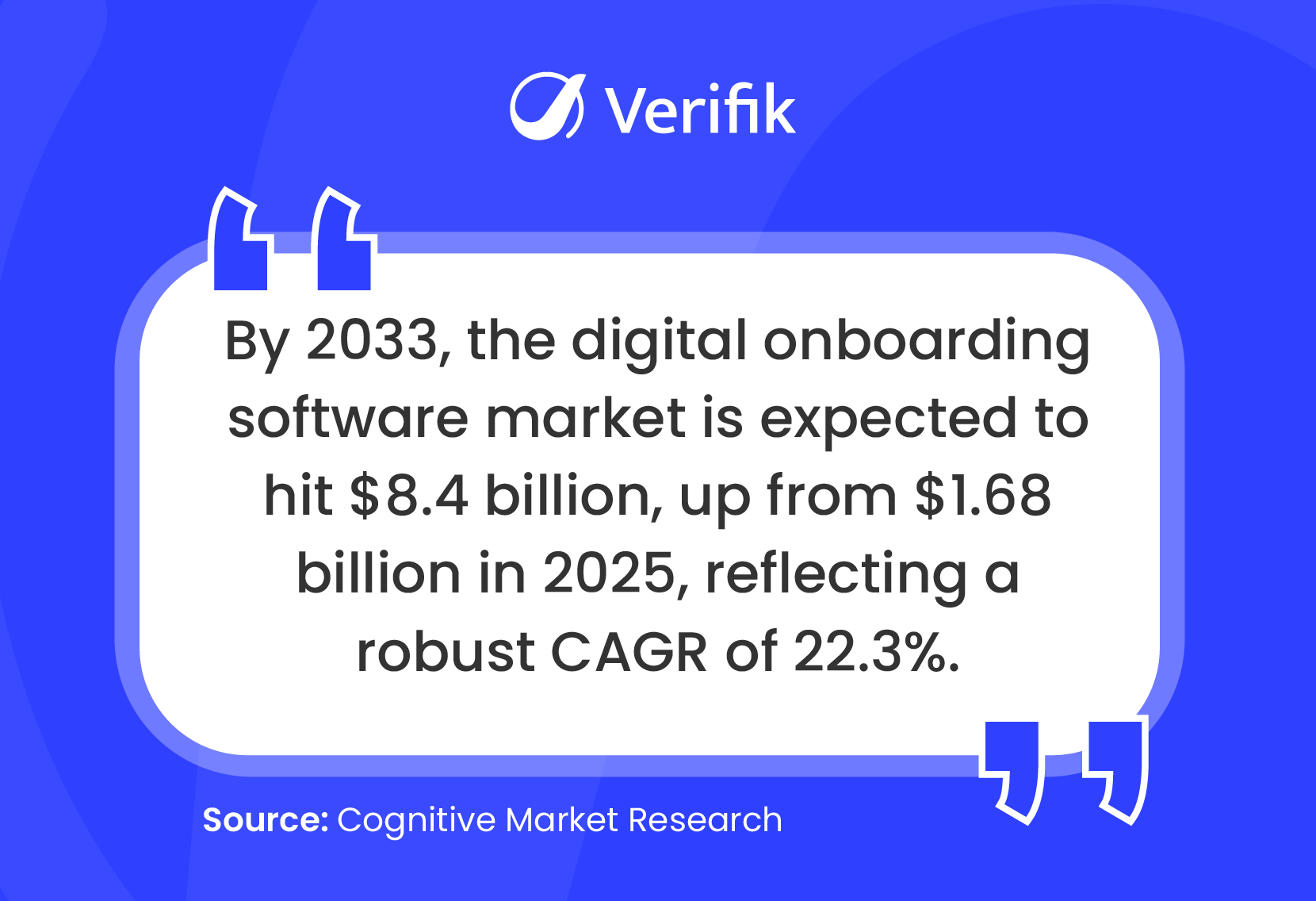

Digital onboarding simplifies how businesses welcome new users by combining speed, security, and a seamless user experience. No surprise the global digital onboarding software market is expected to grow from $1.68B in 2025 to $8.4B by 2033, expanding at a staggering 22.3% CAGR.

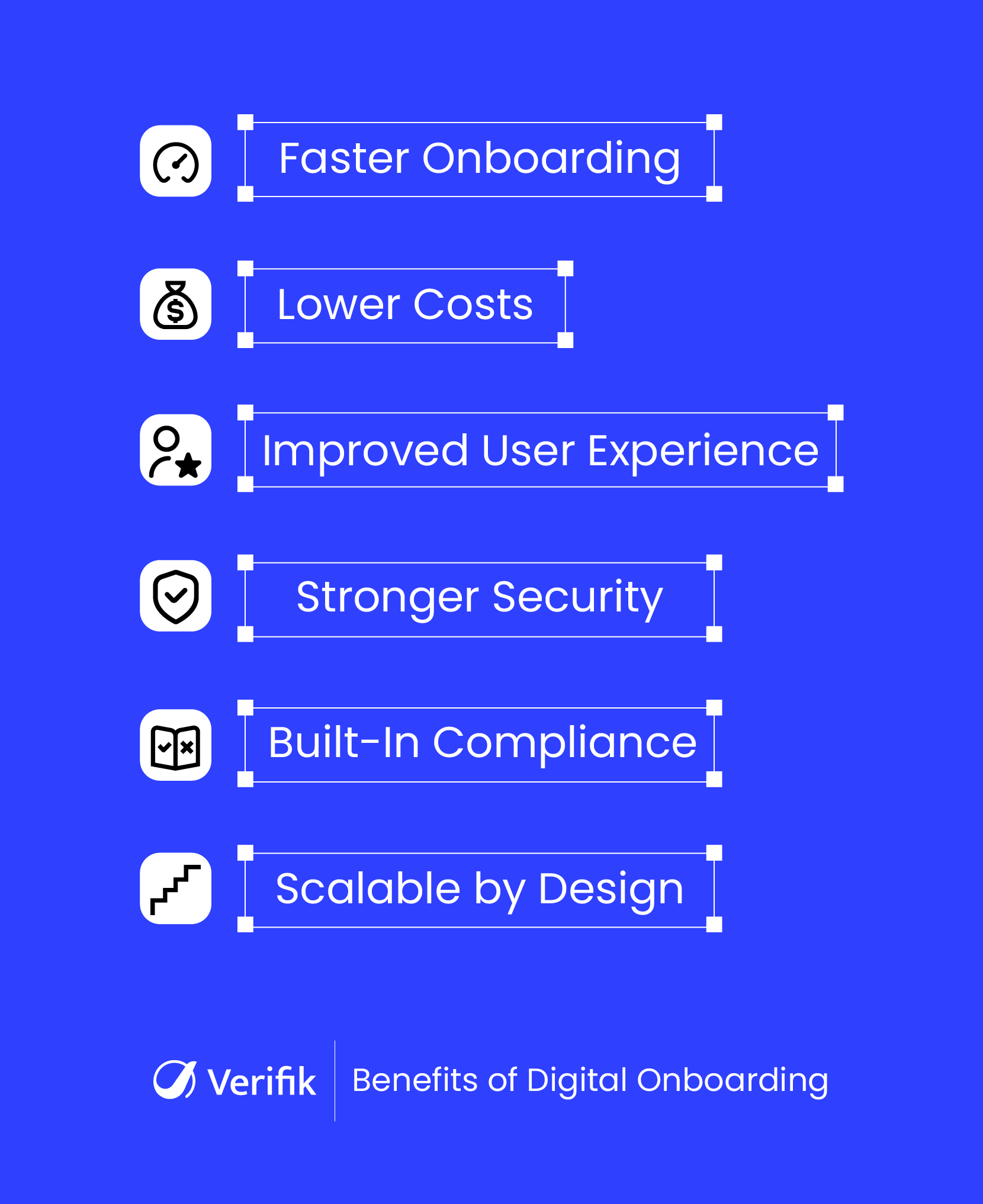

Here are some of the most impactful benefits of adopting a digital onboarding solution:

1. Speed and Convenience

One of the biggest advantages of digital onboarding is how quickly it gets things done. Instead of asking users to visit a physical location or wait days for manual reviews, everything happens instantly through an online journey. From identity verification to document submission, the entire process can be completed in just a few minutes. This kind of speed helps businesses reduce drop-offs and ensures users can access services when they need them.

2. Reduced Operational Costs

Digital onboarding significantly lowers costs related to paperwork, printing, manual data entry, and customer support. With fewer staff hours spent on repetitive tasks and less infrastructure needed to handle physical documentation, businesses can save both time and money. These savings become even more noticeable as the business grows and the volume of onboarding increases.

3. Better User Experience

A poor onboarding experience often leads to user abandonment. Digital onboarding helps prevent this by providing a user-friendly, step-by-step process that feels intuitive. Whether users are signing up through a mobile app or a web browser, the experience is smooth and consistent. Features like auto-fill, progress indicators, and instant feedback make it easy for users to complete the journey without frustration.

4. Stronger Fraud Prevention

Security is a major concern when it comes to onboarding, especially in industries like finance and telecom. Digital onboarding platforms often include built-in security features such as biometric verification, document authenticity checks, and AI-based fraud detection. These tools help identify fake identities, detect anomalies, and block suspicious activities before they become a threat.

5. Regulatory Compliance

Meeting regulatory requirements such as KYC, AML, and GDPR can be challenging if handled manually. Digital onboarding simplifies compliance by automating key steps like ID verification, data logging, and secure storage. Many platforms also come with built-in tools that help you stay aligned with regional laws and industry standards, reducing the risk of penalties or audits.

6. Scalable and Automation-Ready

Digital onboarding is built for scale. As your user base grows, you do not need to expand your team at the same pace. Automated workflows allow you to handle large volumes of signups without sacrificing quality or accuracy. Whether you are onboarding new customers every few minutes or thousands every day, the system keeps up and ensures a consistent process for everyone.

Learn more about how these advantages can transform your business in our blog: 7 Powerful Benefits of Digital Onboarding for Modern Businesses.

Digital Onboarding Process: Step-by-Step

Digital onboarding may vary slightly depending on the industry, but most processes follow a similar structure. Each step is designed to move the user from registration to activation as quickly and securely as possible.

Step 1: Data Collection

The onboarding process begins with collecting basic information from the user. This usually includes filling out a digital form with personal details such as name, date of birth, contact number, and address. Users are also prompted to upload government-issued ID documents like a passport, driver’s license, or national ID card. Some platforms allow users to scan their documents directly using their phone camera, making the experience smoother and more convenient.

Step 2: Identity Verification

Once the documents are submitted, the system verifies the user’s identity. This step often combines multiple technologies such as facial recognition, liveness detection, and optical character recognition (OCR). The user may be asked to take a real-time selfie, which is matched against their ID photo to confirm that the person applying is the rightful owner of the document. Liveness checks help prevent fraud attempts involving photos, videos, or deepfakes.

Step 3: Background & Compliance Checks

After confirming identity, the next step is to ensure the user meets regulatory requirements. The system automatically runs KYC (Know Your Customer) and AML (Anti-Money Laundering) checks in the background. This may include verifying the user’s name against global watchlists, sanctions databases, politically exposed person (PEP) lists, and other risk profiles. Fraud detection tools may also assess behavioral signals and device metadata to flag any suspicious patterns.

Step 4: Approval or Rejection

Once all checks are completed, the system decides whether to approve or reject the application. Many platforms use AI-driven decision engines or rule-based logic to make this decision instantly. In some cases, borderline or flagged applications may be routed to a compliance team for manual review. The goal is to maintain accuracy without introducing unnecessary delays.

Step 5: Access Provisioning

If the user is approved, they are immediately granted access to the service. This could mean enabling their mobile banking app, activating a telecom SIM card, issuing a digital ID, or providing access to an employee portal. At this stage, a welcome message or onboarding tutorial may also be triggered to help the user take their first steps confidently.

If you’re ready to put digital onboarding into action, our blog 10 Best Practices for Effective Digital Onboarding walks you through proven strategies for better results.

Top Use Cases of Digital Onboarding

Digital onboarding is making a real impact across industries where secure identity verification, regulatory compliance, and fast user activation are business-critical. Here’s how different industries are putting it to work:

Banking and Fintech

For banks, digital wallets, and lending platforms, onboarding is a critical first touchpoint. With digital onboarding, customers can open accounts remotely without visiting a branch or filling out paperwork. The process includes instant identity verification, document checks, and real-time KYC and AML screening, all handled automatically. It also speeds up loan applications by automating income verification and risk assessments, making financial services more accessible and efficient.

Not sure how eKYC compares to digital onboarding? Our blog breaks it down: eKYC vs Digital Onboarding: What’s the Difference?

Telecom

Telecom providers use digital onboarding to activate new connections quickly while staying compliant with identity regulations. Instead of visiting a store, customers can register their SIM card by uploading their ID and taking a selfie from their phone. The system verifies the information in real time, reducing manual errors and the risk of fraudulent activations. This is especially valuable in high-volume markets where speed and accuracy are equally important.

Gaming and Gambling

Online gaming and betting platforms often face strict regulations around user identity and age verification. Digital onboarding helps these platforms ensure only eligible users gain access by verifying age, identity, and location in seconds. It also plays a key role in preventing duplicate accounts and minimizing fraud. By integrating compliance checks like AML screening directly into the onboarding flow, platforms can stay aligned with legal requirements without disrupting the player experience.

Healthcare

In healthcare, digital onboarding improves how patients register for services and access care. Patients can fill out forms, upload IDs, verify insurance, and provide consent digitally before arriving for their appointment. This reduces wait times and administrative burden for staff. Identity verification also ensures that sensitive medical records are accessed only by the right people, which is crucial for both privacy and compliance.

Government and Public Sector

Governments are increasingly turning to digital onboarding to modernize public services. Whether it’s issuing national IDs, onboarding passport applicants, or offering virtual notary services, the process becomes faster and more transparent. Citizens can complete these steps from home, avoiding long queues and physical paperwork. At the same time, built-in security and verification tools ensure that only legitimate individuals access official services.

eCommerce and Marketplaces

Online marketplaces rely on trust, and digital onboarding helps build that from the start. Sellers and vendors can register by submitting documents and verifying their identities online, which speeds up approval times and reduces friction. For buyers, onboarding helps detect suspicious behavior early and prevent fraud. With a more secure environment in place, platforms can scale confidently while offering a safer experience to everyone involved.

The potential of digital onboarding is huge, but avoiding common errors is what ensures success. Learn more in our blog: 10 Common Digital Onboarding Mistakes to Avoid.

Challenges in Digital Onboarding

While powerful, digital onboarding also comes with its own set of challenges:

-

Balancing Experience and Security

Adding too many checks can frustrate users. But removing them can increase the risk of fraud. Finding the right balance between a smooth experience and strong security is key.

-

Technical Limitations in Real-world Conditions

Low-light environments, poor internet, or unclear document scans can cause verification failures. These edge cases often affect users in remote areas or those using older devices.

-

Cross-border Compliance Hurdles

For businesses operating in multiple countries, staying compliant with different KYC and AML regulations can be tricky. Onboarding flows must adapt to each region’s legal requirements without slowing things down.

-

Concerns Around Data Privacy

Biometric onboarding raises valid concerns around how user data is stored and protected. Without proper safeguards, businesses risk losing user trust and facing legal issues.

We’ve covered the main points here, but if you want a detailed breakdown of the top digital onboarding challenges (along with ways to address them), take a look at: Top Challenges in Digital Onboarding (and How to Overcome Them).

How to Choose the Right Digital Onboarding Solution

Choosing the right digital onboarding solution can make or break your user experience. The best platforms strike a balance between security, compliance, and seamless user journeys, all while being easy to integrate into your existing systems.

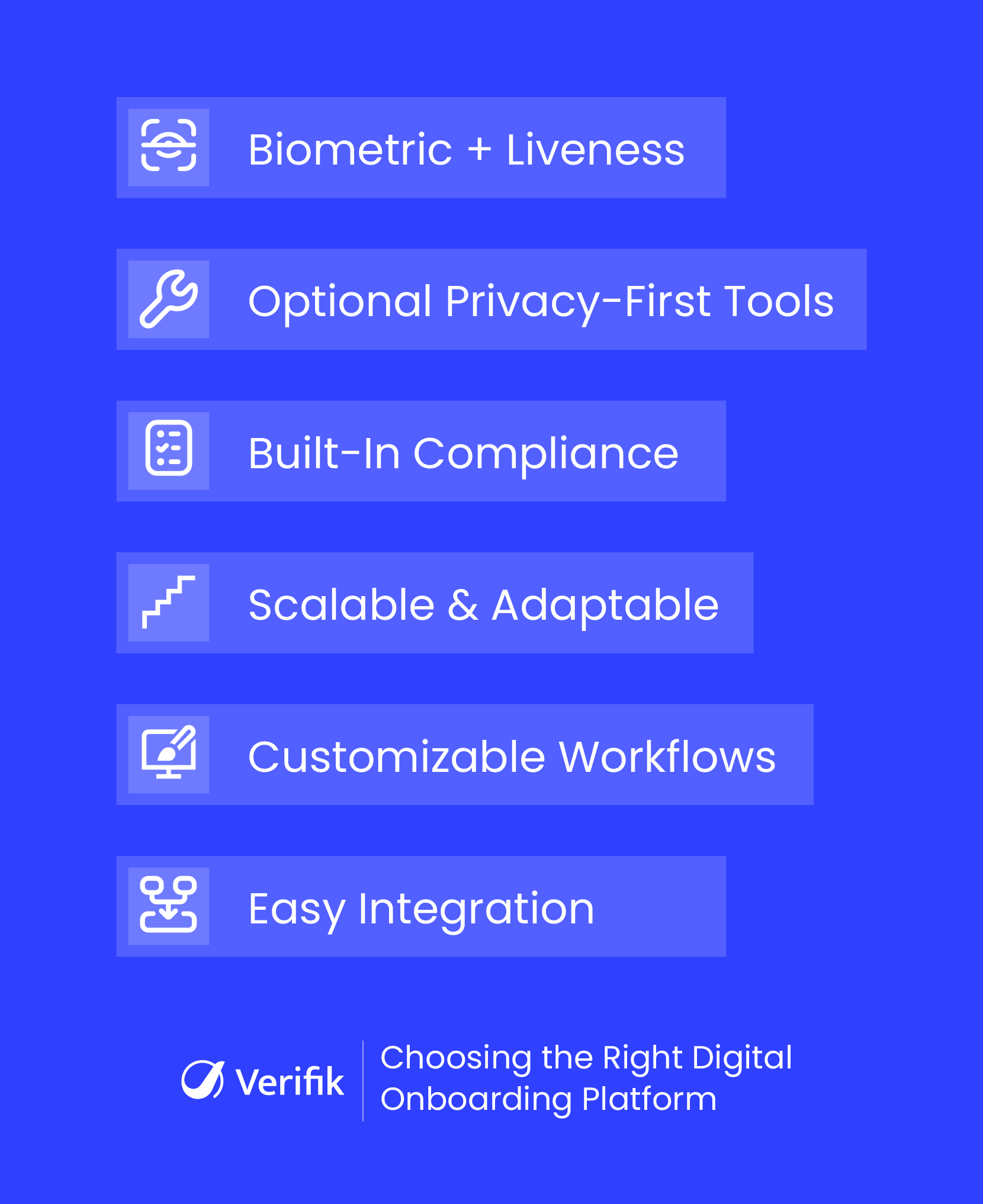

Here’s what to look for when evaluating a digital onboarding platform or provider:

-

Biometric Verification with Liveness Detection

A reliable solution should offer biometric verification combined with liveness checks. This helps prevent spoofing attempts such as deepfake videos, 3D masks, or printed photos, which are becoming more common in identity fraud.

-

Privacy-First Approach (Optional but Highly Valuable)

Some digital onboarding solution providers now offer privacy-first technologies like ZK Face Proof. While not mandatory, adopting such solutions can bring real advantages. They verify users without storing biometric data, reducing data liability and increasing user confidence in how their information is handled.

-

Built-In Compliance for KYC, AML, and GDPR

Your digital onboarding platform should help you meet regulatory obligations. Whether it’s Know Your Customer (KYC), Anti-Money Laundering (AML), or GDPR, built-in support for these standards makes it easier to scale across markets while staying compliant.

-

Scalability Across Regions and Use Cases

The platform should adapt to various workflows, geographies, and identity documents. Whether you’re onboarding customers in finance, gaming, or telecom, the solution should handle it without added complexity.

-

Flexible and Customizable Workflows

A good digital onboarding solution allows you to configure the process to fit your business. Risk levels, customer segments, and onboarding requirements vary, so the ability to tailor the journey is a key feature.

-

Developer-Friendly APIs and SDKs

Your tech team should be able to integrate the solution without heavy lifting. Look for platforms that offer clean APIs and ready-to-use SDKs to speed up development and reduce integration costs.

Implementing digital onboarding can be challenging. Our blog “10 Best Practices for Digital Onboarding Implementation” shows you how to get it right.

Wrapping Up

Digital onboarding simplifies how businesses bring new users on board. It speeds up verification, reduces manual work, and helps you stay compliant without making the process harder for your users. No matter the industry, it creates a smoother first interaction and builds trust from the start.

Verifik is an identity verification platform that offers a range of digital onboarding solutions designed to fit your industry needs. Get in touch to see how we can support your onboarding goals!