We live in a time where users expect services to be instant, seamless, and secure. Whether opening a bank account, signing up for a telecom service, or accessing a digital wallet, the first interaction—onboarding—sets the tone for the entire relationship. That’s where digital onboarding steps in.

Digital onboarding is now a critical part of customer acquisition across various industries, from banking and healthcare to gaming and government services. And at the heart of it lies biometric verification, which is making identity checks faster, safer, and smarter.

In this guide, we’ll walk you through what digital onboarding really means, how it works, and why biometrics are playing such a big role in its evolution. Let’s get into it!

What is Digital Onboarding?

Digital onboarding is the fully online process by which businesses verify and register new users or customers using digital tools and technologies, without the need for physical paperwork or face-to-face interactions.

It involves collecting user information, verifying their identity (often using government-issued IDs and biometric methods like facial recognition), performing compliance checks such as KYC (Know Your Customer) and AML (Anti-Money Laundering), and completing any necessary agreements or consents electronically.

Digital onboarding makes it easier, faster, and more secure for businesses to bring on new customers, whether it’s for banking, telecom, eCommerce, gaming, or government services.

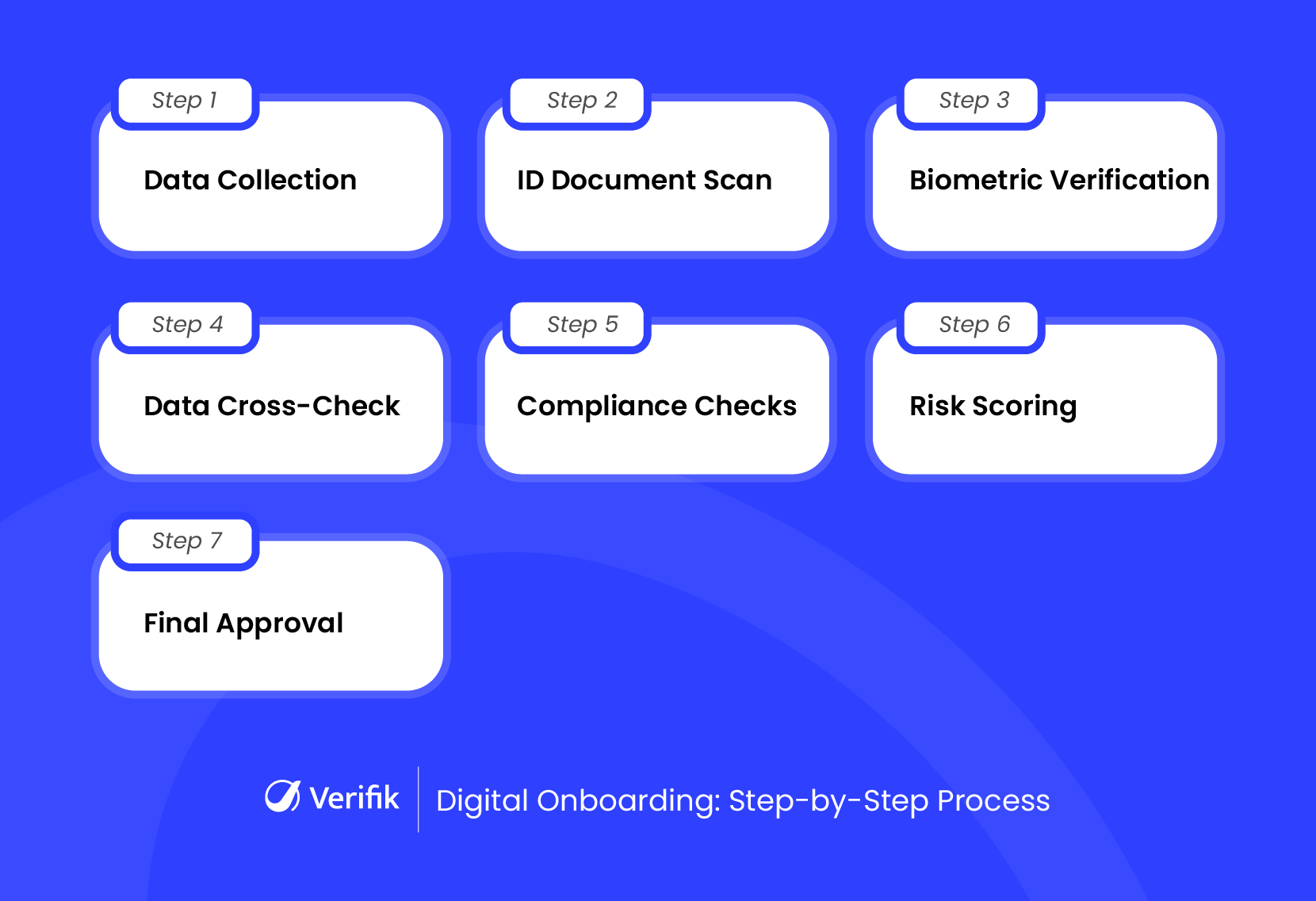

Key Steps in a Digital Onboarding Process

A well-designed digital onboarding system works quietly behind the scenes by collecting data, verifying identity, and approving users within seconds. While it feels simple on the surface, it’s doing a lot in the background. Here’s a breakdown of how a typical process works from start to finish:

Step #1: Basic Data Collection

The process begins with the user submitting key information through a digital form or app-based input. The system prompts them to enter:

- Full name

- Date of birth

- Email and phone number

As users fill out the form, the system automatically checks for formatting errors, missing fields, and inconsistencies. This early validation ensures clean and usable data from the start.

Step 2: Scanning and Reading ID Documents

After capturing basic details, the digital onboarding software requests a government-issued ID, such as a passport, national ID, or driver’s license. This step is completed via a device’s camera or file upload function within the app or web interface.

The system then:

- Scans the document in real time

- Extracts key fields using OCR (Optical Character Recognition)

- Checks for authenticity, expiration, and potential tampering

No manual data entry is required to reduce human error and improve speed.

Step 3. Biometric Identity Verification

Next, the digital onboarding system prompts the user to take a selfie or record a short live video directly within the platform. It then:

- Matches the face with the photo on the ID

- Uses liveness detection to confirm the user is physically present

- Blocks spoofing attempts such as static photos or video replays

This biometric step significantly reduces the risk of identity fraud.

Step 4. Cross-Checking Submitted Information

Behind the scenes, the system compares the user-submitted data (via the form or app) with the extracted data from the ID. For example:

- Do the names match?

- Is the date of birth consistent?

Any mismatch is flagged instantly for review, helping prevent false entries or fraudulent attempts.

Step 5. Automated Compliance Checks

To meet regulatory standards, the digital onboarding solution runs a series of automated background checks, including:

- Sanctions and watchlist screenings (OFAC, UN, EU, etc.)

- Politically Exposed Persons (PEP) detection

- Anti-Money Laundering (AML) checks

These checks are fast and invisible to the user to ensure compliance without delay.

Step 6. Decision Making and Risk Scoring

With all verifications complete, the system applies risk scoring rules and business logic to decide whether to:

- Approve the user automatically

- Escalate the case to manual review

- Reject onboarding due to risk signals

Most legitimate users receive near-instant approvals.

Step 7. Final Approval and Access

If the user successfully completes all previous steps and is approved by the system, the digital onboarding system automatically grants them access to the requested service or platform.

At this stage, the system:

- Sends a confirmation via email, SMS, or in-app notification

- Activates the user’s account without requiring any manual intervention

The entire process is seamless, ensuring the user can begin using the service immediately after approval.

Role of Biometric Verification in Digital Onboarding

Biometric verification is a key enabler of secure and seamless digital onboarding. By using physical traits like facial features or fingerprints, it allows businesses to confirm a user’s identity in real-time without manual checks or paperwork.

Biometric Technologies Used in Digital Onboarding Systems

- Facial Recognition: Matches user’s face with their ID photo

- Liveness Detection: Ensures the person is physically present

- Fingerprint & Iris Scanning (less common in remote onboarding)

Why Biometrics Are Effective in Digital Onboarding

- Fast: Takes a few minutes to verify a user

- Secure: Difficult to fake or spoof

- Frictionless: No need to remember passwords or codes

Example: Biometric Onboarding in Action

A fintech app can onboard a new user in under 2 minutes using just a selfie and an ID upload. The system handles:

- Facial matching

- Liveness detection

- Document authenticity checks

All without manual input to make the digital onboarding process seamless and secure.

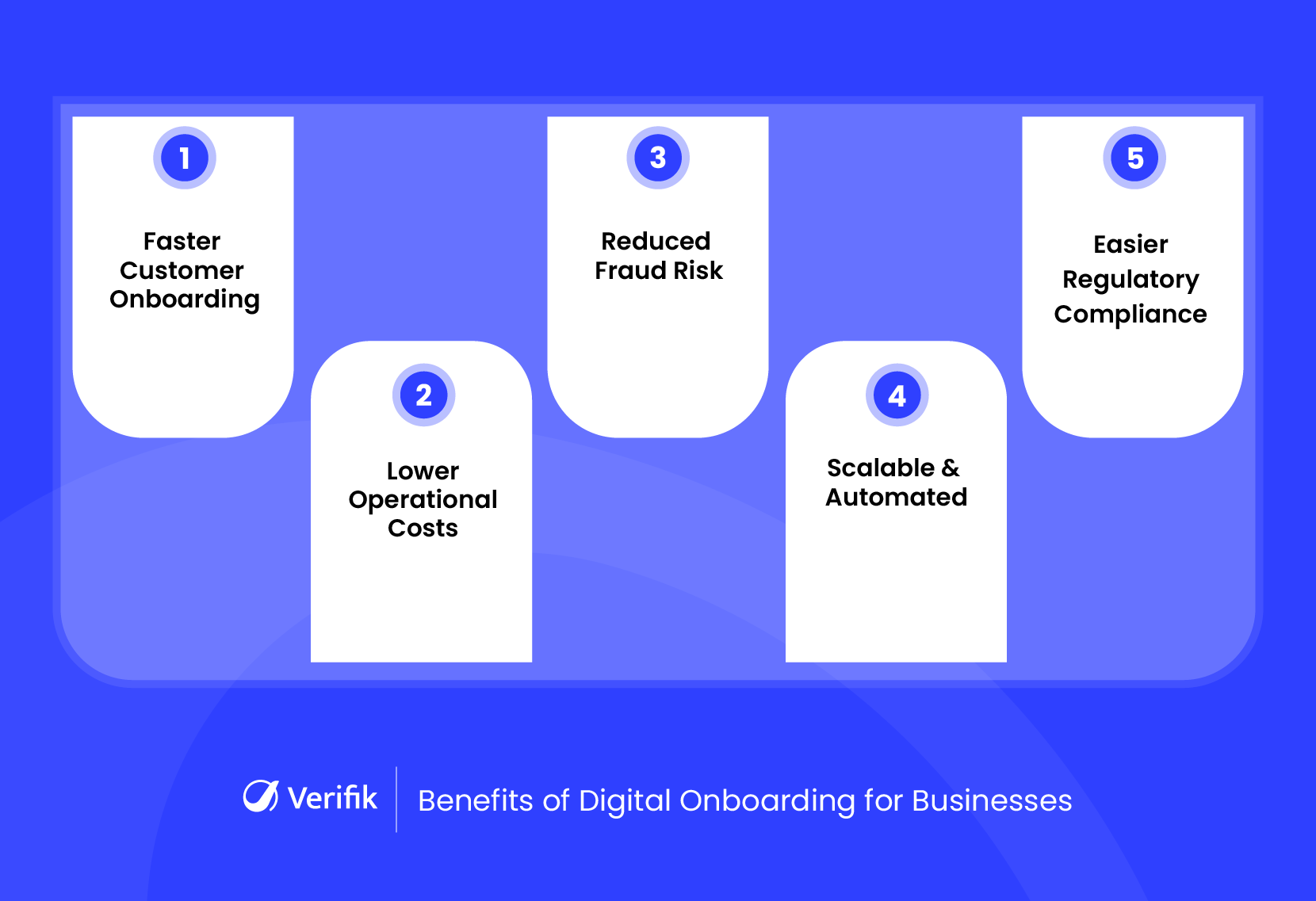

Benefits of Digital Onboarding for Businesses

Digital onboarding offers a faster, safer, and more efficient way to bring new users on board. Here are the key benefits:

1. Faster Customer Acquisition

Digital onboarding systems dramatically reduce the time it takes to bring new users or customers on board. With automated identity verification, form filling, and document checks, what once took hours or days can now be done in minutes.

Why it matters:

- Fewer drop-offs during sign ups

- Faster time-to-service for new users

- Higher conversion rates from onboarding flows

2. Reduced Operational Costs

By automating tasks that were previously manual, such as document reviews, data entry, and customer support interactions, digital onboarding software helps lower overhead costs and frees up internal resources.

Where it saves:

- Less need for manual KYC staff

- Fewer errors and rework

- Shorter support and processing cycles

3. Lower Fraud and Identity Theft Risks

With integrated biometric verification, liveness checks, and document validation, digital onboarding platforms are built to detect and block fake identities, duplicate accounts, or fraudulent attempts in real time.

Security advantages:

- Prevents account takeovers and impersonation

- Stops use of stolen or synthetic IDs

- Protects platform reputation and user trust

4. Scalability and Automation

Digital onboarding systems can handle thousands of users simultaneously, across different time zones and regions, without affecting performance. This makes it ideal for businesses experiencing growth or seasonal spikes in demand.

What you gain:

- Onboarding that scales with your user base

- 24/7 availability with no human dependency

- Consistent processes regardless of volume

5. Regulatory Compliance Made Easier

Whether you operate in finance, healthcare, telecom, or any other regulated sector, digital onboarding software helps ensure compliance with KYC, AML, and data protection laws. All verification steps are logged, traceable, and audit-ready.

Compliance benefits:

- Built-in ID checks against official databases

- Tamper-proof audit trails

- GDPR, CCPA, and regional data privacy alignment

Real-World Applications of Digital Onboarding

Digital onboarding is now widely used across industries to verify identities remotely, reduce fraud, and speed up customer signups. Here are some common use cases across industries:

-

Banks and Fintechs

Banks and fintechs use digital onboarding to make identity verification fast and convenient. Customers can open accounts, apply for loans, or sign up for apps entirely online, without visiting a branch. This speeds up credit scoring and approval processes while enhancing security and preventing fraud.

-

Telecom

Telecom companies leverage digital onboarding to let users register SIM cards remotely. By verifying IDs and using biometric checks, they reduce fraud and cut down the hassle of in-person visits. This creates a smoother, faster, and safer experience for customers.

-

eCommerce & Gaming

Digital onboarding helps eCommerce and gaming platforms quickly verify users’ age and identity. Using biometrics and document checks, they prevent fraud and keep minors from accessing restricted content. This builds trust and keeps the platform compliant with regulations.

-

Healthcare

Patients can verify their identity from home before telemedicine appointments through digital onboarding. This protects sensitive health data and ensures compliance with privacy laws like HIPAA. It also makes healthcare services more accessible and hassle-free.

-

Government

Governments use digital onboarding to issue digital IDs and official documents without requiring citizens to visit offices. By submitting documents and completing biometric checks online, the process becomes quicker and more secure, improving access to public services for everyone.

Best Practices for Implementing Digital Onboarding

Implementing digital onboarding effectively requires careful planning and attention to security, privacy, and user experience. Following best practices ensures your digital onboarding process is smooth, compliant, and trusted by customers:

-

Use Multi-Layered Verification

Relying on just one verification method can leave gaps in security. Solutions like smartENROLL combine document verification, biometric checks such as facial recognition, and liveness detection to create a more secure onboarding flow. This multi-layered approach not only strengthens fraud prevention but also improves verification accuracy and builds user trust.

-

Offer Fallback Options for Accessibility

Not every user can complete biometric verification due to device limitations or disabilities. Providing fallback options such as manual identity checks or OTP (one-time password) verification makes onboarding inclusive and prevents drop-offs.

-

Ensure Global Compliance

Different regions have different privacy laws, and non-compliance can lead to penalties. Your onboarding system should be adaptable to meet regulations like GDPR in Europe and CCPA in California. Keeping updated with these laws protects your business and customers.

-

Partner with a Reliable Tech Provider

The effectiveness of your onboarding process relies heavily on the technology and expertise behind it. Choosing an experienced digital onboarding solutions provider ensures strong biometric accuracy, built-in compliance support, and a secure user experience. The right partner helps you onboard faster, prevent fraud, and stay aligned with global regulations.

Wrapping Up

Digital onboarding is transforming how businesses connect with customers by making it quicker and safer to get people on board. This guide has covered why biometric verification and automation matter more than ever. With faster onboarding times and stronger fraud prevention, your business can scale confidently and provide a seamless customer experience. For businesses ready to scale and build trust, investing in digital onboarding is a smart move.

How Verifik Can Help

Verifik is a leading provider of digital onboarding solutions that help businesses verify customer identities quickly, accurately, and securely. Our flagship solution, smartENROLL, combines facial recognition, liveness detection, and ID document checks to deliver a reliable and efficient digital onboarding experience.

Ready to revolutionize your onboarding? Book a free demo of smartENROLL and start today!