Today’s users expect to sign up, verify their identity, and start using digital platforms within minutes. Whether it’s a banking app, a ride-hailing service, or an e-commerce store, digital onboarding is the process that makes it all happen. It’s how businesses create a secure and seamless first experience for new customers.

But behind the scenes, digital onboarding can be anything but smooth. Many companies face issues like user drop-offs, fraud risks, and compliance hurdles that disrupt the flow. In this blog, we’ll look at the most common challenges in digital onboarding and how to overcome them without compromising speed, security, or user trust.

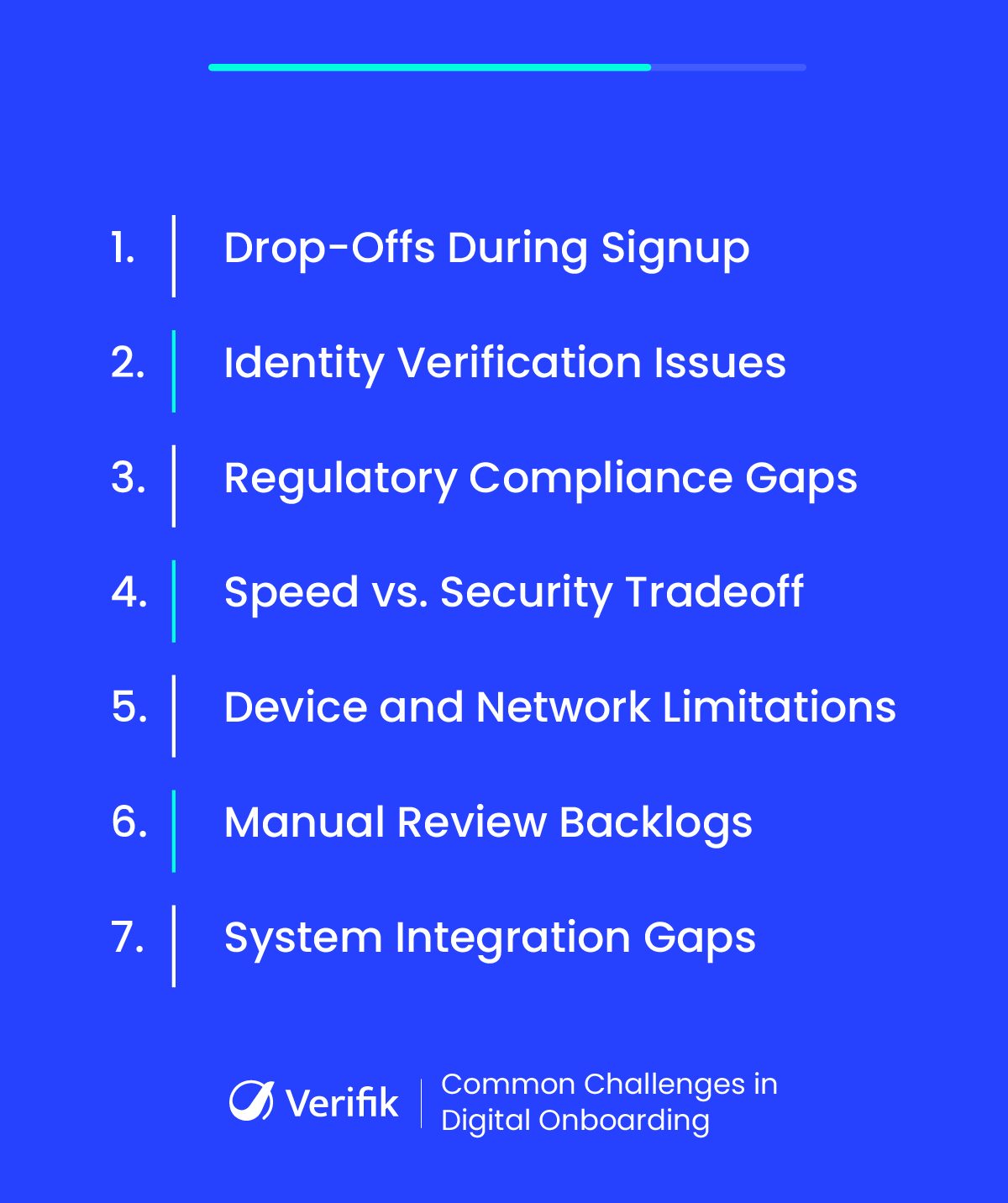

1. High Drop-Off Rates During Onboarding

One of the most common digital onboarding challenges is user abandonment. According to a recent survey, 80% of customers say that the onboarding experience influences their decision to stay or leave. When users are asked to fill out lengthy forms, upload hard-to-find documents, or go through multiple confusing steps, they often give up midway.

How to fix it:

Simplify the journey. Break the process into smaller steps and give users a sense of progress. Use dynamic forms that ask only what’s necessary based on previous answers. Include save-and-resume features and error messages that are clear and helpful. Prioritize convenience without compromising on essential checks.

2. Verifying User Identity Accurately

With deepfakes, identity theft, and synthetic fraud on the rise, relying on manual document checks or basic selfie verification no longer cuts it. Many platforms struggle to confidently verify if the person signing up is who they claim to be.

How to fix it:

Go beyond document scanning. Integrate biometric checks such as facial recognition combined with liveness detection to ensure the user is real and present. Cross-verify data from multiple sources like government IDs, credit bureaus, or telcos to strengthen identity confidence without slowing the process down.

3. Meeting Regulatory Requirements (KYC/AML/GDPR)

Regulatory compliance is not optional, especially for financial platforms, digital wallets, and crypto exchanges. But meeting these requirements digitally, at scale, and across borders can be complex.

How to fix it:

Choose onboarding systems that are pre-built for KYC and AML compliance. These systems should collect and store data in a secure, structured way, generate audit trails automatically, and stay updated with regulatory changes. Ensure your privacy policy is transparent and users have control over their data in line with GDPR and other data laws.

4. Balancing Speed with Security

A fast signup process creates a positive first impression. But if you remove too many checks for speed, you risk inviting fraudsters. On the other hand, adding too much friction can turn away legitimate users.

How to fix it:

Use adaptive onboarding, where you tailor the experience based on the user’s risk profile. For trusted users, keep it fast and light. For higher-risk cases, introduce additional steps only when needed. Background risk checks using AI and behavioral analysis allow you to keep the process secure while still feeling seamless to most users.

5. Handling Diverse User Devices and Network Conditions

Digital onboarding needs to work for everyone, from users with the latest smartphones to those on low-end devices or patchy mobile data. If your platform is too heavy or buggy on certain devices, you risk losing users you didn’t even get to assess.

How to fix it:

Make your platform universally accessible. Optimize for mobile, use compressed media formats, and design for lower resolutions and slower connections. Use device testing and real-time performance monitoring to identify weak points and improve continuously. Consider offering QR-based onboarding flows or offline ID capture where needed.

6. Manual Reviews Piling Up

When most signups end up in manual review, the onboarding process slows down. Customers get frustrated waiting for approval, and your team wastes time on cases that could’ve been cleared faster.

How to fix it:

Let automation handle the bulk of verification work. Train your systems using real-world fraud patterns so they can confidently approve low-risk users. Reserve manual reviews for edge cases and high-risk anomalies. Adding feedback loops helps refine your system over time and reduce false positives.

7. Poor Integration with Internal Tools

When your onboarding system doesn’t connect with your CRM, analytics, or fraud tools, things quickly get messy. You end up with mismatched records, double work, and a disjointed user experience.

How to fix it:

Choose a digital onboarding platform that plays well with the rest of your tech stack. Look for solutions that offer open APIs and easy integration with your existing tools. When your systems sync in real time, your teams work faster, your data stays clean, and your users enjoy a smoother journey from signup to activation.

Final Thoughts

Digital onboarding offers incredible potential, but only when the process is thoughtfully designed. From preventing fraud to speeding up approvals, every step should focus on building trust, simplifying the user journey, and allowing your system to scale. Businesses that overlook weak points in their onboarding flow risk losing valuable users and opening the door to unnecessary risk.

The upside is that these challenges are fixable with the right strategy and technology in place.

Looking to improve your digital onboarding experience?

Reach out to Verifik and see how we help businesses onboard users faster, safer, and smarter without the usual compromises!