We’ve all seen the terms “eKYC” and “digital onboarding” tossed around like they mean the same thing. And to be fair, they do sound pretty similar. Both involve identity checks, documents, and customers signing up for something online. But here’s the truth: they’re not the same. Not even close.

Understanding the difference between eKYC and digital onboarding can help you choose the right technology, avoid unnecessary costs, and build better experiences for your users. So, let’s break it all down!

What is eKYC?

Let’s start with the basics. eKYC stands for electronic Know Your Customer. It’s the digital version of a process that businesses, especially those in regulated industries, have been doing for decades. The goal? To make sure the person you’re dealing with is actually who they claim to be.

eKYC typically includes the following steps:

- Scanning and verifying identity documents

- Matching the ID photo with a selfie using facial recognition

- Performing liveness detection to ensure it’s a real person

- Cross-checking information against global watchlists or databases (for AML and fraud checks)

eKYC is all about compliance. It’s required by banks, fintechs, crypto platforms, telecom companies, and even some government services. If you’re onboarding a user and need to meet KYC or AML regulations, eKYC is how you do it at scale and online.

Think of eKYC as the identity checkpoint. It’s the security guard at the entrance who checks your ID before letting you into the building.

What is Digital Onboarding?

Now, digital onboarding is something much broader. It’s the entire process of bringing a customer, user, or employee into your system. That includes identity verification, yes, but also a lot more.

Here’s what digital onboarding might involve:

- Account creation and password setup

- Filling out forms or uploading documents

- Accepting terms and conditions

- Personalized welcome flows or tutorials

- System setup or service activation

- Integration with CRMs, ERPs, or internal platforms

While eKYC is focused on compliance and identity, digital onboarding is focused on the experience. It’s about guiding someone from “I’m interested” to “I’m ready to start using your product”: quickly, easily, and without friction.

Imagine you’re booking a hotel online. eKYC would be like showing your ID at check-in. Digital onboarding would be the entire booking experience, from choosing your room and paying, to getting the confirmation email and keycard.

Key Differences Between eKYC and Digital Onboarding

Let’s get into the main reasons these two concepts are not interchangeable.

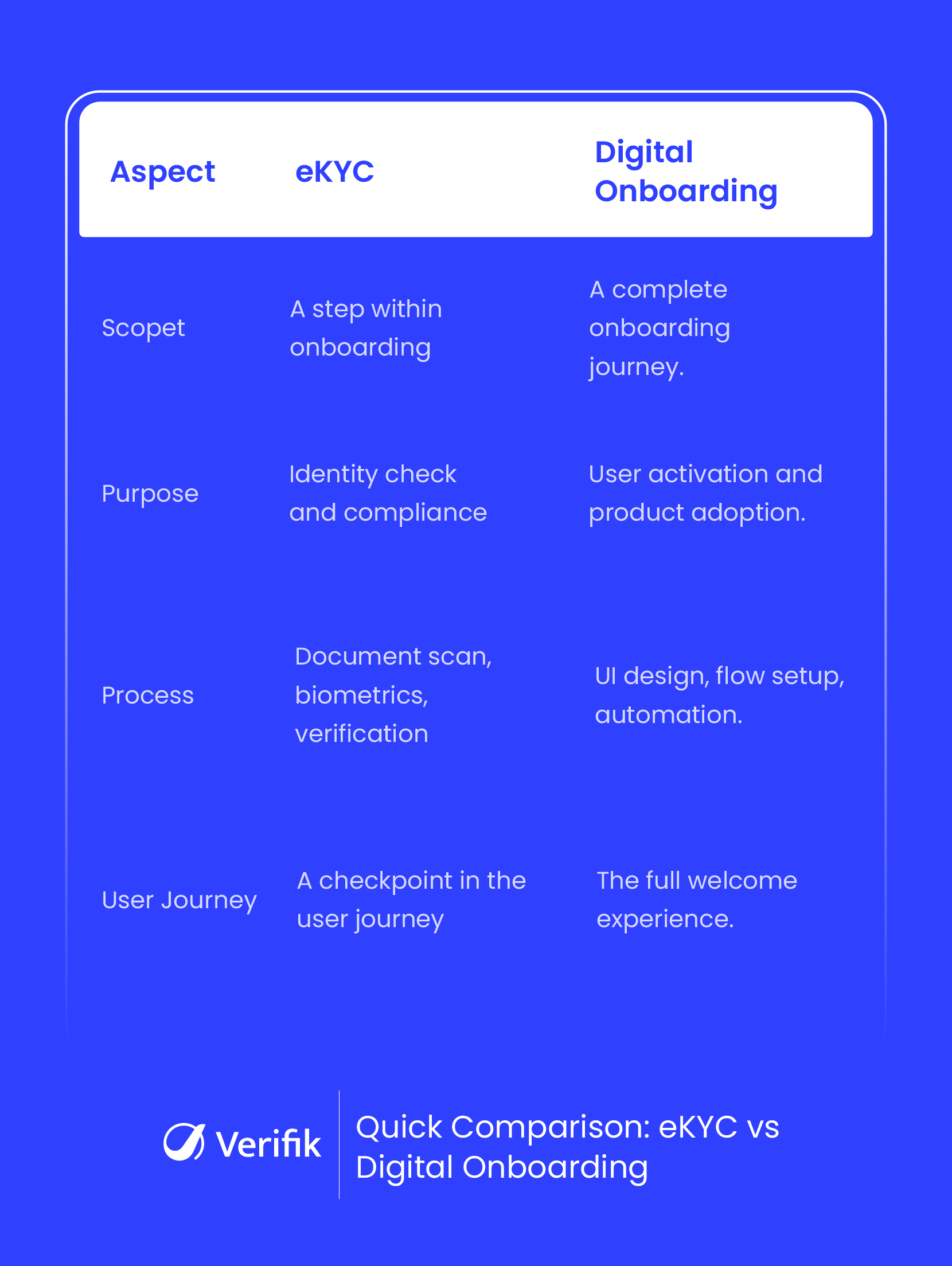

1. Scope

eKYC is a step within the onboarding process. Digital onboarding includes eKYC, but also covers all the touchpoints that come before and after. If onboarding were a movie, eKYC would be just one scene.

2. Purpose

The purpose of eKYC is to verify identity and meet legal or regulatory obligations. On the other hand, the purpose of digital onboarding is to introduce users to your service, activate them, and help them start using your product successfully.

3. Process

eKYC involves document scanning, biometric checks, and backend verification. Digital onboarding includes UI design, customer experience flows, integrations, and automation. One is heavily compliance-driven, the other is experience-driven.

4. User Journey

eKYC is usually just a checkpoint in the middle of the user journey. Digital onboarding is the full welcome tour. It begins when a customer first engages with your product and ends when they are fully onboarded and ready to use it.

Where eKYC and Digital Onboarding Overlap

It’s easy to see why people confuse the two. In many cases, eKYC is embedded right inside digital onboarding flows. Let’s say someone signs up for a fintech app. They download the app, enter their email, set a password, and then get asked to verify their identity. That identity verification step is eKYC, but the whole process they’re going through is digital onboarding.

In fact, a Thomson Reuters survey found that banks can take up to 48 days to onboard corporate clients, and 89% of corporate treasurers said they had a poor KYC experience. That’s a big reason financial firms are increasingly embedding eKYC into their digital flows to streamline the experience and avoid customer frustration.

Both processes often use the same technology stack:

- Mobile or web-based interfaces

- Automation and AI

- Secure cloud infrastructure

- Real-time decision-making

- APIs to connect with CRMs or compliance tools

So yes, they’re connected. But not the same.

Why the Difference Matters for Businesses

If you’re wondering why this distinction matters, here’s the deal: it can save you a lot of headaches. Businesses that understand the difference are better equipped to:

● Choose the Right Vendors

Not every solution that offers eKYC handles full digital onboarding. If you need a smooth, brand-aligned onboarding experience, you may need a different toolset than one focused purely on ID verification.

● Track the Right Metrics

If your goal is compliance, you’ll track pass rates, match scores, and false positive rates. If you’re focused on onboarding, you’ll want to measure activation rates, drop-offs, and time to value.

● Avoid Scope Creep

Many teams underestimate the scope of digital onboarding because they assume it’s just eKYC. Then they realize they still need to build dashboards, set up workflows, and connect with their CRM. Understanding the full onboarding flow helps you plan better.

● Deliver Better Experiences

Customers don’t think in terms of “eKYC” and “onboarding.” They just want the process to be fast and painless. Knowing how these parts fit together helps you build a smoother, more human-centered experience.

Which One Do You Need?

The short answer? Probably both. But it depends on your industry and your goals.

For Financial Services and Crypto

You need both. eKYC is required by law. Digital onboarding helps you compete by making the process seamless and enjoyable.

For Telecom or eCommerce

You might not always need full eKYC unless your service involves age verification or fraud risk. But digital onboarding is still crucial for user acquisition and retention.

For SaaS Platforms or Marketplaces

If your users need accounts or need to activate features, digital onboarding is a must. eKYC may be optional depending on your business model.

Final Thoughts

In the rush to go digital, it’s easy to assume all onboarding solutions do the same thing. But there’s a clear difference between verifying someone’s identity and making them feel welcomed, guided, and ready to use your service.

eKYC is about proving who someone is. Digital onboarding is about turning that someone into a customer, a user, or even a fan of your brand.

Get both right, and you’ve not only covered your compliance needs, you’ve also delivered a modern experience that builds trust from the very first interaction.

Need a Solution That Does Both?

Verifik’s smartENROLL handles digital onboarding and eKYC in one smooth and secure flow.

Schedule your free demo today!