For fast-growing digital businesses, identity verification is no longer just an IT or compliance function, it’s a strategic asset. It affects how quickly you can onboard users, how well you manage risk, and how confidently you can expand into new markets. The stakes are high, and so is the pressure to choose the right solution.

In this blog, we’ll explore the critical criteria to consider when evaluating identity verification solutions, so you can make a decision that aligns with both your risk profile and your business goals.

What Is an Identity Verification Solution?

An identity verification solution is a digital system designed to confirm that a person is who they claim to be. It compares user-provided information, such as a selfie, ID document, or biometric trait, against authoritative data sources or pre-existing templates. The goal is to ensure that only legitimate users are granted access to services or accounts.

These solutions are critical in both regulated industries (like finance and healthcare) and consumer-focused sectors (like e-commerce and online gaming). They help organizations reduce fraud, ensure compliance with legal obligations, and improve onboarding workflows. Modern identity verification solutions are often API-driven, cloud-based, and customizable to different use cases and risk levels.

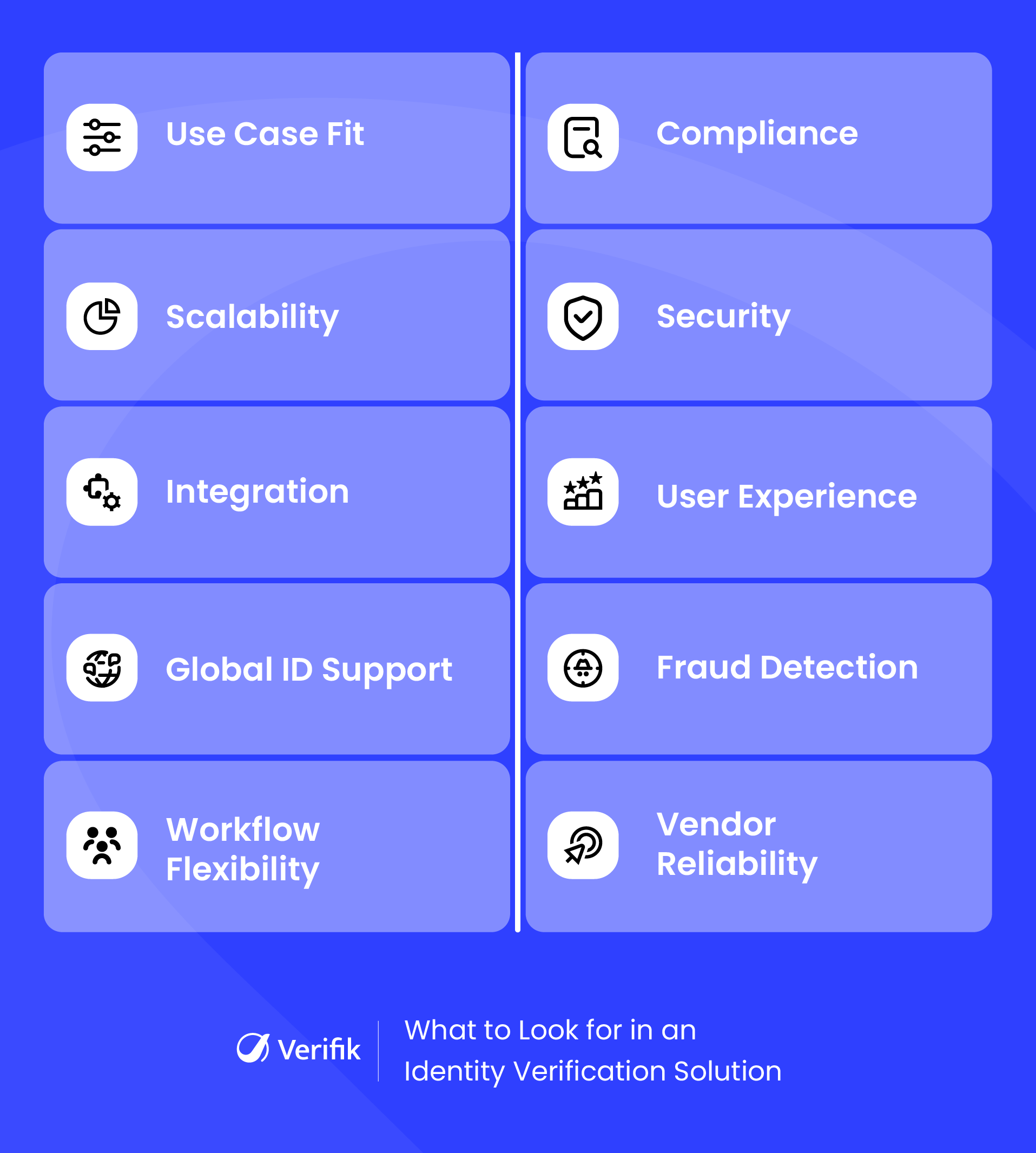

Key Factors to Consider When Choosing an Identity Verification Solution

With global identity fraud losses surpassing $50 billion annually, choosing the right verification solution is critical, not just for compliance, but for protecting your brand and users.

Below are the critical factors to evaluate before making a decision:

1. Use Case and Industry Relevance

Not all identity verification solutions are built the same. A solution that works for a crypto exchange might not suit a government e-service or online marketplace.

Ask yourself:

- Are you verifying users during sign-up, high-risk transactions, or for age-restricted access?

- Is your goal fraud prevention, compliance, or both?

- Do you need recurring identity checks or just one-time verification?

Choose a solution that’s purpose-built for your use case and has proven success in your industry. Look for industry-specific compliance, workflow customization, and fraud detection tailored to your risk model.

2. Regulatory Compliance

If your business operates in a regulated environment or handles sensitive user data, you must meet regional and industry-specific compliance standards.

Key compliance features to look for:

- Built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks

- GDPR or CCPA compliance for data privacy

- Automatic audit trails for regulators

- Secure data retention and deletion policies

Some solutions also offer country-specific configurations to match local laws and ID formats, which can significantly ease expansion.

3. Scalability and Performance

Today you may verify 1,000 users a month, tomorrow it might be 100,000. Your identity solution must grow with you.

Evaluate:

- API response times under load

- System uptime and availability (look for 99.99%+ SLAs)

- Ability to scale across geographies

- Load balancing and latency in different regions

A truly scalable solution won’t slow you down during growth or seasonal spikes.

4. Security and Data Protection

Security isn’t just about encryption, it’s about how data is collected, processed, and stored.

Ask the vendor:

- Do you store biometric data or operate on a zero-storage model?

- Is data encrypted at rest and in transit?

- Are you compliant with ISO 27001, SOC 2, or other security standards?

- How is access to sensitive data controlled internally?

Your provider must treat identity data like a vault treats gold, with strict controls and no shortcuts.

5. Ease of Integration

No matter how powerful an identity verification solution is, it’s not useful if it takes six months to implement.

Look for:

- Clean, well-documented APIs and SDKs (especially for Android, iOS, and web)

- Sandbox/test environments for development teams

- Support for custom workflows and decision logic

The faster your solution gets up and running, the quicker you start seeing value.

6. User Experience and Conversion Rates

Verification should be effortless. A clunky or delayed process not only frustrates users but also leads to higher drop-off rates and less trust in your business.

Key UX considerations to consider:

- How long does identity verification take on average?

- Is the experience optimized for mobile, desktop, and tablets?

- Is the interface available in multiple languages?

- Does it support users with disabilities?

The best identity verification solutions minimize friction while maintaining accuracy and security.

7. Global Document and ID Support

If your users are international, your verification system must recognize and process a wide range of government-issued IDs.

What to look for:

- Coverage of passports, national IDs, driver’s licenses, and residence permits

- OCR accuracy and auto-classification for different ID types

- AI-based fraud detection across various ID types

Broad document support translates into higher match rates and less manual review.

8. Fraud Detection and Accuracy

False positives frustrate legitimate users. Missed fraud exposes your platform to risk.

Select an identity verification solution that offers:

- High accuracy in facial recognition and document verification

- Advanced liveness detection (active and passive)

- Deepfake and spoofing detection

- Risk scoring and anomaly detection

Ask for benchmark data or case studies. Don’t rely on vague claims, insist on numbers.

9. Workflow Flexibility and Custom Rules

You may not need every check for every user. Flexibility helps you balance speed, cost, and risk.

Evaluate:

- Can you set risk-based workflows (e.g., skip selfie for low-risk users)?

- Can the system trigger manual review based on custom rules?

- Does it support tiered verification for different jurisdictions or product types?

Customization ensures your identity verification solution fits your business, not the other way around.

10. Vendor Reputation and Support

Technology is only part of the picture, partnering with the right vendor matters just as much.

Partner with an identity verification platform that offers:

- Reviews, case studies, and client references

- Customer support availability (24/7 vs. business hours)

- Account management and onboarding assistance

- Product roadmap transparency

A reliable partner can help you adapt quickly as regulations change or fraud patterns evolve.

Conclusion

There’s no one-size-fits-all solution when it comes to identity verification. The right choice depends on your industry, risk level, user demographics, and long-term growth plans.

By focusing on compliance, fraud prevention, user experience, scalability, and privacy, you can build an identity verification process that not only protects your business but also earns customer trust.

Choose wisely. Because in today’s digital economy, trust is everything.

Ready to Choose Smarter? Choose Verifik.

Verifik isn’t just another identity verification provider, we’re your long-term partner in secure, compliant, and seamless user authentication.

- Fast, secure, and accurate solutions

- Zero biometric storage powered by ZK Face Proof

- Supports ID documents from 150+ countries

- Fully customizable and low-friction verification flows

- Compliant with global standards (KYC, AML, GDPR)

- Easy API integration

From onboarding to ongoing authentication, Verifik gives you the confidence to scale securely and stay compliant.

Let’s Talk or Book a Demo to see our next-gen identity verification solutions in action!