Database screening plays a critical role in helping digital platforms protect themselves from fraud, financial crimes, and regulatory risks. Whether it’s a fintech company onboarding new users, a gaming platform ensuring fair play, or a business meeting compliance checks, database screening ensures only verified and legitimate entities pass through.

However, the process is not as straightforward as it sounds. Companies often face hurdles like outdated data, integration issues, and strict regulations that often makes the process difficult to manage. These challenges, if not addressed properly, can lead to false alerts, compliance gaps, and poor user experience.

In this blog, we’ll look at the most common challenges companies face in database screening and share practical ways to overcome them.

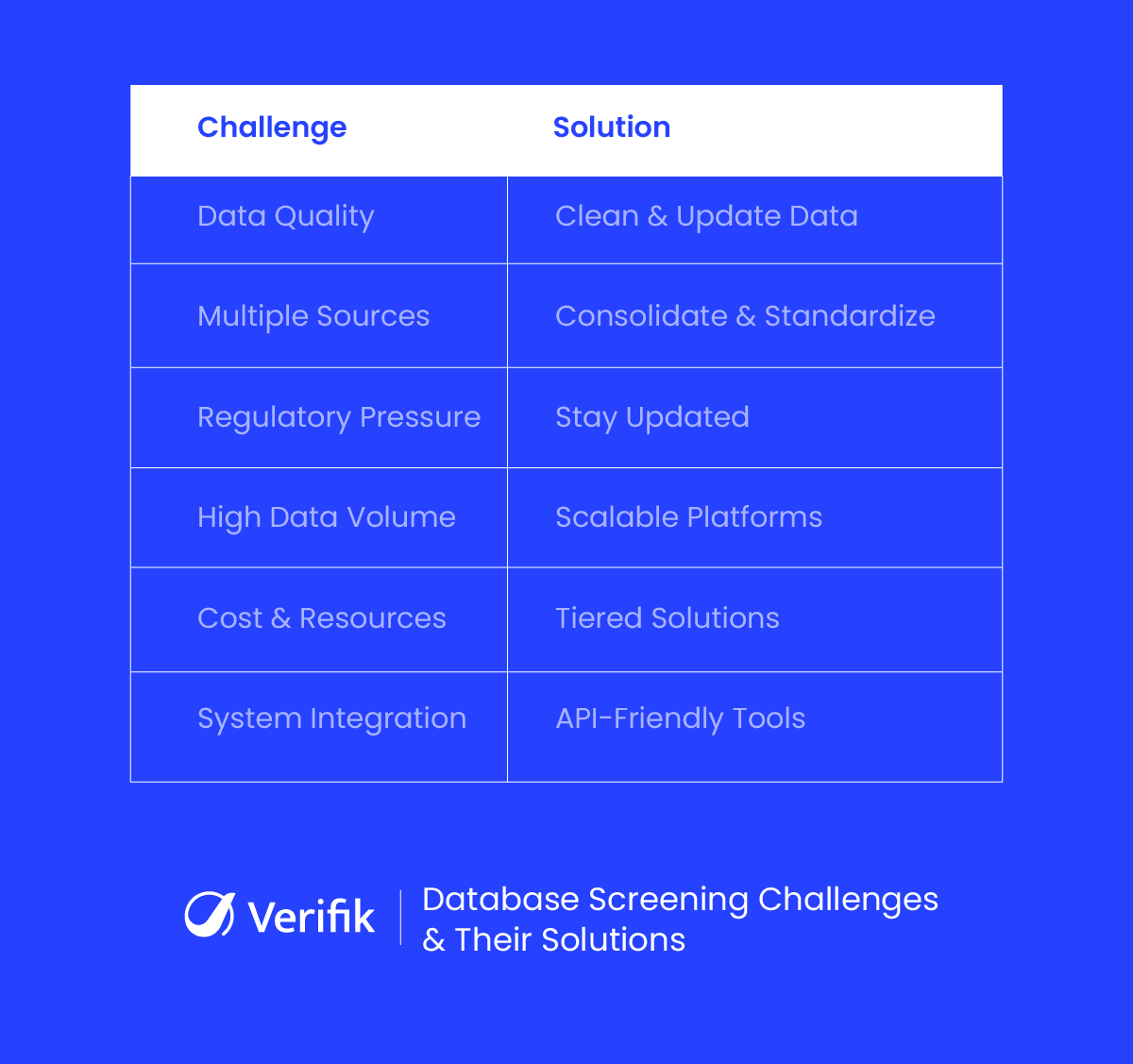

Common Challenges in Database Screening

1. Data Quality and Accuracy

Database screening is only as good as the data behind it. If customer records are outdated, incomplete, or filled with errors, the screening process becomes unreliable. For example, a slight misspelling in a name or missing identification detail could result in false negatives, allowing a risky individual to slip through undetected.

On the other hand, bad data can also generate false positives, which take up valuable time and resources to review. Businesses often underestimate how much poor data quality can weaken their compliance efforts, which makes accuracy one of the biggest pain points in screening.

2. Multiple Data Sources

Most organizations rely on information pulled from a wide range of sources, such as global watchlists, sanctions databases, law enforcement records, and internal data systems. Each of these sources may store information in a different format or use different standards for recording names, dates, or addresses. Bringing all of that information together into one standardized dataset is a complex task.

Without careful consolidation, businesses risk creating overlaps, duplications, or mismatches that slow down the entire screening process and make it less reliable.

3. Compliance and Regulatory Pressure

Regulatory frameworks around customer verification and anti-money laundering are constantly evolving. What was acceptable last year may no longer meet the compliance threshold today. This creates ongoing pressure for businesses to stay updated and adjust their screening systems accordingly. Falling behind even slightly can mean hefty fines, loss of licenses, or reputational damage that takes years to rebuild.

The real challenge is that businesses often operate across multiple regions, each with its own set of regulations, making compliance even more complex.

4. High Volume of Data

For industries like finance, e-commerce, or telecommunications, the number of daily transactions and customer records can be overwhelming. Screening tens of thousands of entries in real time without slowing down approvals or onboarding is no small task.

When systems aren’t designed to handle such volumes, issues occur. This not only delays business processes but can also frustrate customers who expect quick and seamless services. Over time, inefficient handling of data volume can affect both customer satisfaction and operational productivity.

5. Cost and Resource Constraints

Implementing robust screening solutions requires both money and expertise. Advanced platforms with strong security and compliance features often come with a steep price tag.

On top of that, businesses need trained compliance officers and IT specialists to manage the systems. Smaller companies or startups often find themselves stuck; knowing the importance of screening but lacking the resources to implement it effectively. This financial strain can leave gaps in protection and expose them to risks.

6. Integration with Existing Systems

Many organizations still run on legacy systems that were never designed to handle modern compliance needs. Integrating new screening tools with these older systems can be complex, costly, and time-consuming. When integration doesn’t go smoothly, data gets stuck in silos, leading to inefficiencies and higher risks of errors.

In the worst cases, integration issues can cause system downtime, disrupting everyday business operations. For companies trying to modernize, this challenge becomes one of the biggest stumbling blocks.

Overcoming Common Database Screening Challenges

1. Invest in Reliable Screening Tools

Modern screening tools powered by AI and machine learning are built to improve both speed and accuracy. These solutions can detect subtle patterns that manual checks or outdated systems would miss. They also update automatically, ensuring businesses always work with the latest watchlists and regulatory changes. While the initial investment may seem high, the long-term benefits of reducing risks, saving time, and avoiding penalties far outweigh the costs.

2. Regular Data Cleansing and Maintenance

Even the most advanced system can fail if the underlying data is messy. Businesses should establish strict processes for cleaning and updating records by removing duplicates, correcting mistakes, and standardizing formats. This not only makes screening more accurate but also improves efficiency across all departments. By prioritizing data governance, organizations ensure that their screening system always has a strong foundation to build on.

3. Stay Ahead of Compliance Requirements

Compliance is not something businesses can afford to treat reactively. It requires constant monitoring of regulatory updates and industry trends. Companies that invest in compliance experts or adopt tools that adapt quickly to changing regulations reduce their risk of falling behind. Proactively building compliance into business strategy, rather than scrambling to meet new laws, helps avoid both penalties and reputational damage.

4. Scalable Screening Solutions

As businesses grow, so does the volume of data they need to screen. A system that works for a small customer base may not handle millions of records efficiently. That’s why scalability is crucial. Cloud-based platforms allow businesses to handle high volumes without straining infrastructure or requiring massive upfront investment. This flexibility ensures that screening remains smooth as the company expands into new markets or customer segments.

5. Optimize Costs through Smart Adoption

Not every company needs the same level of screening sophistication. Smaller organizations can reduce costs by adopting tiered solutions that match their specific needs. Another option is outsourcing certain screening functions to specialized service providers, which gives access to expertise and technology without the full cost of ownership. By aligning investment with business size and risk profile, companies can remain compliant without overspending.

6. Smooth Integration Practices

Choosing tools that offer strong API support and compatibility with existing systems can make integration far less painful. A phased rollout—starting with critical functions and gradually expanding—reduces disruptions to daily operations. Regular testing and collaboration between IT and compliance teams also help address issues early before they escalate. With the right approach, integration becomes a step toward efficiency rather than an obstacle.

Wrapping Up

Database screening is no longer just a compliance requirement. It’s a safeguard that protects businesses from fraud, ensures trust, and keeps operations aligned with global standards. While challenges like unreliable data, regulatory pressure, and integration issues can complicate the process, they are not insurmountable. With the right tools and strategies, businesses can turn screening into a competitive advantage rather than a burden.

Transform the Way You Screen with smartCHECK

If your business is looking to overcome database screening challenges without the complexity, smartCHECK by Verifik is built for you. Our solution combines advanced AI-driven matching with real-time access to global watchlists, ensuring accurate and efficient screening. With no compromise on compliance, smartCHECK helps you reduce false positives, speed up onboarding, and stay aligned with ever-changing regulations.

Whether you are a financial institution, gaming platform, or digital service provider, smartCHECK integrates smoothly with your systems to provide fast, reliable, and secure screening at scale.

Book a free demo with Verifik today and see how smartCHECK can transform your screening process.