Database screening has become one of the most critical steps for businesses looking to protect themselves from fraud, stay compliant with regulations, and build trust with their customers. Whether you’re in finance, e-commerce, healthcare, or even gaming, chances are your business is already using some form of screening to verify individuals and organizations before working with them.

But here’s the challenge: database screening comes with its own language, and not everyone is familiar with the terms that shape this process. From sanctions lists to adverse media and PEPs, these terms hold the key to understanding how risks are identified and managed.

In this blog, we’ll break down 10 of the most important database screening terms every business leader, compliance officer, or decision-maker should know. By the end, you’ll have a clearer picture of what these terms mean and why they matter for your organization.

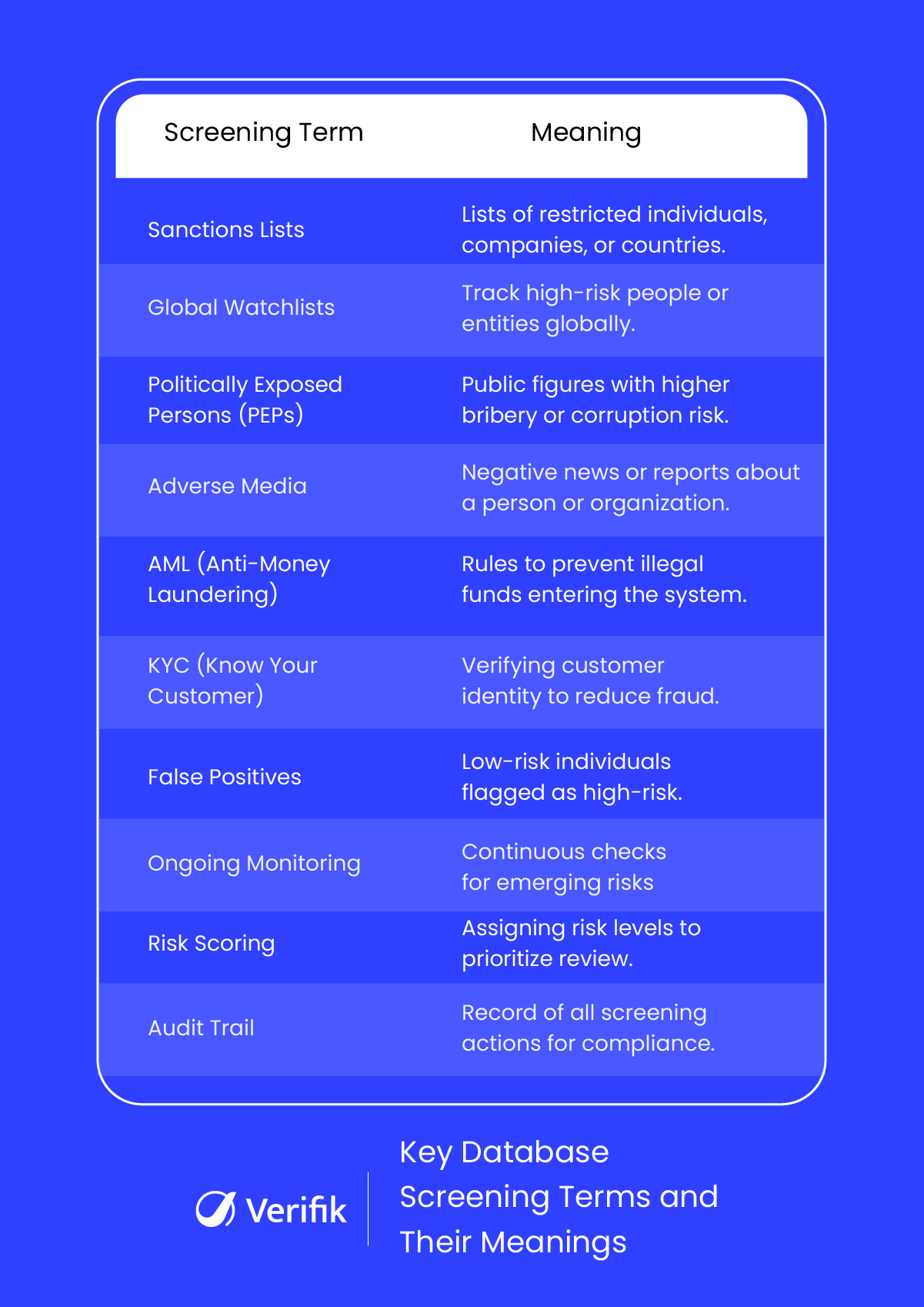

1. Sanctions Lists

Sanctions lists are official records maintained by governments or international organizations that identify individuals, companies, or countries restricted from doing business. These restrictions often target illegal activities, terrorism, or political violations. Screening against these lists helps businesses avoid legal penalties and ensures they don’t engage with high-risk entities. Regular checks against sanctions lists are a critical step in maintaining regulatory compliance.

2. Global Watchlists

Global watchlists track individuals and organizations considered high-risk on an international scale. They include people under investigation, persons of interest, or entities linked to financial crimes. Unlike sanctions lists, they provide a broader view of potential threats. Businesses use these lists to enhance risk detection and make informed decisions before onboarding clients or partners.

3. Politically Exposed Persons (PEPs)

PEPs are individuals holding or having held prominent public positions, such as government officials, senior politicians, or executives of state-owned enterprises. Due to their influence, they may pose higher risks of bribery, corruption, or money laundering. Identifying PEPs ensures companies comply with AML and KYC regulations. It also protects businesses from reputational damage associated with high-risk connections.

4. Adverse Media

Adverse media refers to negative news coverage or reports about individuals or organizations, including fraud allegations, lawsuits, or criminal activities. Screening for adverse media uncovers risks that may not appear in official watchlists or sanctions lists. This provides businesses with a more complete view of potential threats. Incorporating adverse media checks helps companies avoid risky relationships and protect their brand reputation.

5. AML (Anti-Money Laundering)

AML represents laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. Database screening supports AML compliance by identifying suspicious individuals or organizations before financial transactions occur. Companies that follow AML guidelines reduce legal exposure, protect assets, and maintain stakeholder trust. Integrating AML checks into routine operations is essential for businesses in high-risk industries.

6. KYC (Know Your Customer)

KYC is the process of verifying the identity of customers to prevent fraud and comply with regulatory requirements. Database screening plays a vital role in KYC by helping businesses verify that their customers, clients, or partners are trustworthy and pose minimal risk. Effective KYC processes improve trust and transparency. They also help businesses avoid fines or penalties related to onboarding high-risk entities.

7. False Positives

A false positive occurs when a screening system flags a low-risk individual or entity as high-risk. While these alerts do not indicate real threats, they can slow down onboarding and consume valuable resources. Businesses need systems to quickly review and verify these results. Reducing false positives improves efficiency while ensuring that real risks are not overlooked.

8. Ongoing Monitoring

Ongoing monitoring involves continuous checks of customers, employees, or vendors after initial screening. This ensures any emerging risks are detected promptly to maintain compliance over time. It helps businesses adapt to changing circumstances, such as updated sanctions or adverse media reports. Regular monitoring strengthens risk management and keeps operations secure.

9. Risk Scoring

Risk scoring assigns a numerical or categorical value to individuals or entities based on screening results. It helps businesses prioritize high-risk cases for deeper investigation. Scores are determined by factors such as sanctions hits, PEP status, or adverse media findings. Using risk scores allows companies to make faster, more informed decisions while focusing resources where they are needed most.

10. Audit Trail

An audit trail is a detailed record of all screening activities, including results, actions taken, and decisions made. Maintaining an audit trail is crucial for regulatory compliance and demonstrates due diligence. It also allows businesses to review historical decisions, resolve disputes, and prepare for audits. A clear audit trail strengthens transparency and accountability across the organization.

Conclusion

Understanding these 10 database screening terms is more than just industry knowledge. It is a practical way to keep your business safe, compliant, and efficient. From sanctions lists to global watchlists, and audit trials, each term plays a key role in a strong screening process that helps prevent fraud, regulatory breaches, and reputational damage.

Experience Smarter Database Screening Today

The right technology can make database screening faster, easier, and far more reliable for your business. smartCHECK by Verifik offers a comprehensive solution that automates database screening across global watchlists, sanctions lists, PEPs, and adverse media. It updates in real time, integrates seamlessly into your workflows, and gives you accurate, actionable insights without slowing down operations.

Take control of your compliance and risk management today. Book a free 30-minute demo of smartCHECK and see how smarter database screening can protect and grow your business.