Smarter KYC for Growing BNPL Platforms

Fast and safe verification.

Los negocios BNPL necesitan un KYC ágil y seguro para crecer. Con smartENROLL y smartACCESS, Verifik permite verificar usuarios reales al instante, sin fricciones ni contraseñas, evitando fraudes e intentos de toma de cuentas.

SOLUTION

Fraud is Growing in BNPL—Is Your Business Safe?

Buy Now, Pay Later (BNPL) services are making shopping easier for consumers—but also for fraudsters. Without proper verification, your platform could face:

Stolen identities leading to fake signups

Account takeovers that put real users at risk

High fraud rates that result in revenue loss and regulatory fines

That’s why leading BNPL providers rely on Verifik’s smartENROLL & smartACCESS to

Stolen identities leading to fake signups

Account takeovers that put real users at risk

High fraud rates that result in revenue loss and regulatory fines

PRODUCT

Transform BNPL Security with Verifik’s Next-Gen Solutions

Approve More Customers While Staying Fraud-Free

Verifik helps BNPL platforms onboard real users instantly with smartENROLL’s automated KYC and secure every login with smartACCESS’s passwordless authentication. Here’s how our solutions make it happen:

Fast-Track User Onboarding with Secure KYC

BNPL users expect instant approvals, but fraudsters exploit weak verification methods. smartENROLL ensures legitimate users are onboarded seamlessly while detecting and blocking fraudulent signups.

ID & Facial Authentication

Scan, extract, and verify identity documents in real-time.

Facial Recognition & Liveness Detection

Ensure the user is present and prevent deepfake or synthetic fraud.

Database & Watchlist Validation

Cross-checks user details with global databases and AML lists.

Fully Automated KYC

Reduces onboarding dropout rates while ensuring compliance.

Fraud-Proof Account Logins

BNPL accounts are prime targets for credential stuffing, phishing, and account takeovers. smartACCESS eliminates password risks with biometric authentication that ensures only the rightful user can log in.

Passwordless Logins

Facial recognition & OTP-based authentication.

Multi-Factor Protection

Defends against unauthorized access and takeovers.

Frictionless Experience

Faster logins, fewer support tickets, and happier users.

Regulatory Compliance

Built for KYC, AML, and GDPR standards.

INTEGRATION

Future-Proof Your BNPL Security with Verifik

Join the leading BNPL providers already leveraging our expertise in cybersecurity to dominate competitive markets.

BNPL platforms scaling in high-risk, high-reward markets.

Fintechs juggling cross-border compliance and fraud prevention.

Startups needing enterprise-grade security without the overhead.

Seamless Integration, Zero Hassle

Adding smartENROLL and smartACCESS to your BNPL platform is fast, straightforward, and hassle-free. Our lightweight, well-documented APIs allow you to integrate advanced identity verification and passwordless authentication without complex development work.

How It Works:

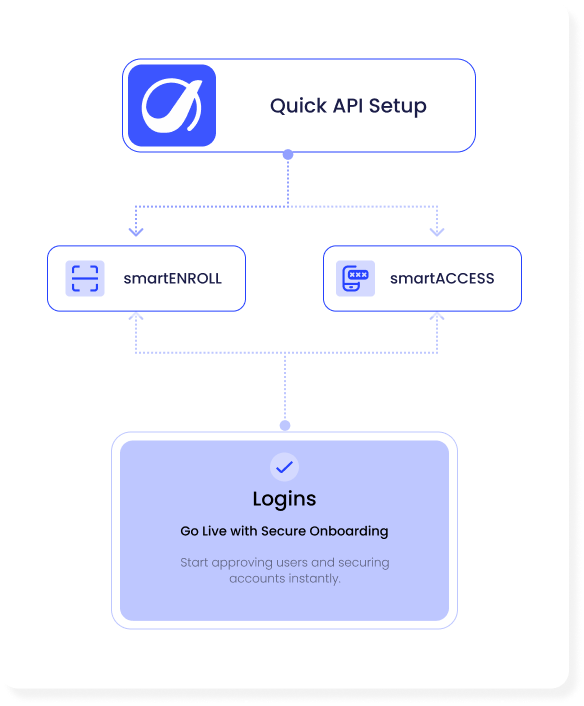

- Quick API Setup – Our documentation guides you through the simple integration steps.

- Define Your Verification Flow – Choose how you want to verify users (ID scan, facial recognition, OTP, etc.).

- Go Live with Secure Onboarding & Logins – Start approving users and securing accounts instantly.

Scale Your BNPL Platform with Secure KYC

Don’t let fraud and friction hold you back. Verifik’s KYC solutions are your shortcut to secure growth.

Frequently Asked Questions (FAQs)

BNPL platforms need to approve users fast without opening the door to fraud—and that’s where Verifik comes in. Our smartENROLL solution automates KYC with real-time ID checks, facial recognition, and database verification. Meanwhile, smartACCESS eliminates passwords with secure biometric logins to keep accounts safe and accessible.

Fraudsters try to slip through with fake IDs, stolen identities, or deepfakes, but smartENROLL shuts them down. It scans documents for authenticity, matches faces with liveness detection, and cross-checks global databases to ensure only real users get approved.

Unlike passwords, which can be stolen or forgotten, smartACCESS provides passwordless login with biometric authentication and OTP-based access. This enhances security, reduces fraud risks, and improves user experience.

Absolutely! Both smartENROLL and smartACCESS are fully customizable to match your platform’s requirements, branding, and security needs. Our no-code and API-driven integrations make implementation seamless.

Yes! Our solutions are designed for easy integration via APIs. Whether you’re using a custom-built system or a third-party BNPL platform, our well-documented APIs ensure a smooth setup without disrupting your existing workflows.

Getting started is easy! Request a demo, and our team will guide you through the setup process. You can integrate our APIs quickly and start securing your BNPL platform in no time.

Need More Information?

Our team is here to help—reach out for details, technical support, or a demo.