Database screening has become a crucial part of modern business operations. Every organization that deals with customers, partners, or suppliers faces risks such as fraud, financial crime, or regulatory non-compliance. Database screening helps businesses identify high-risk individuals or entities before they cause harm to ensure safer transactions and smoother operations.

With the right approach, database screening not only protects your company from legal and financial penalties but also strengthens trust with your customers and partners. In this guide, we’ll explore what database screening is, why it matters, the types of screening available, and how businesses can implement it effectively to stay secure and compliant.

What is Database Screening?

Database screening is the process of checking individuals, organizations, or entities against specific databases to identify potential risks. These databases can include global watchlists, government sanctions lists, politically exposed persons (PEP) lists, criminal records, and other sources that track fraudulent or high-risk activity.

If you are new to the concept, check out our blog on “10 Database Screening Terms Every Business Should Know“ to get familiar with the key terms used in database screening.

The goal is simple: make informed decisions before engaging with a person or business. Database screening helps detect red flags, such as connections to criminal activity, financial fraud, or regulatory violations, before they become costly problems.

The process typically involves automated software that scans multiple databases in real time to provide businesses with instant insights. This allows teams to act quickly, whether it’s approving a new customer, onboarding an employee, or partnering with a new vendor.

Common use cases of database screening include:

- Compliance Checks: Ensuring adherence to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

- Fraud Prevention: Identifying suspicious activity or risky entities before transactions occur.

- Employee Screening: Verifying background information during recruitment.

- Client and Partner Verification: Avoiding reputational and financial risks when onboarding new businesses or clients.

How Database Screening Works

Database screening follows a simple but structured process that helps businesses detect risks quickly. Here’s how it usually works:

- Data Collection – The business gathers key information such as names, IDs, company details, or transaction records.

- Matching and Verification – This data is checked against databases like sanctions lists, PEP registers, criminal records, and adverse media sources.

- Flagging Results – If there’s a match, the system alerts the business to review the case and decide whether to move forward.

The databases used can be internal (like past customer records) or external (such as international watchlists and regulatory databases). Together, they create a safety net that helps organizations make informed choices and stay compliant.

Key Types of Database Screening

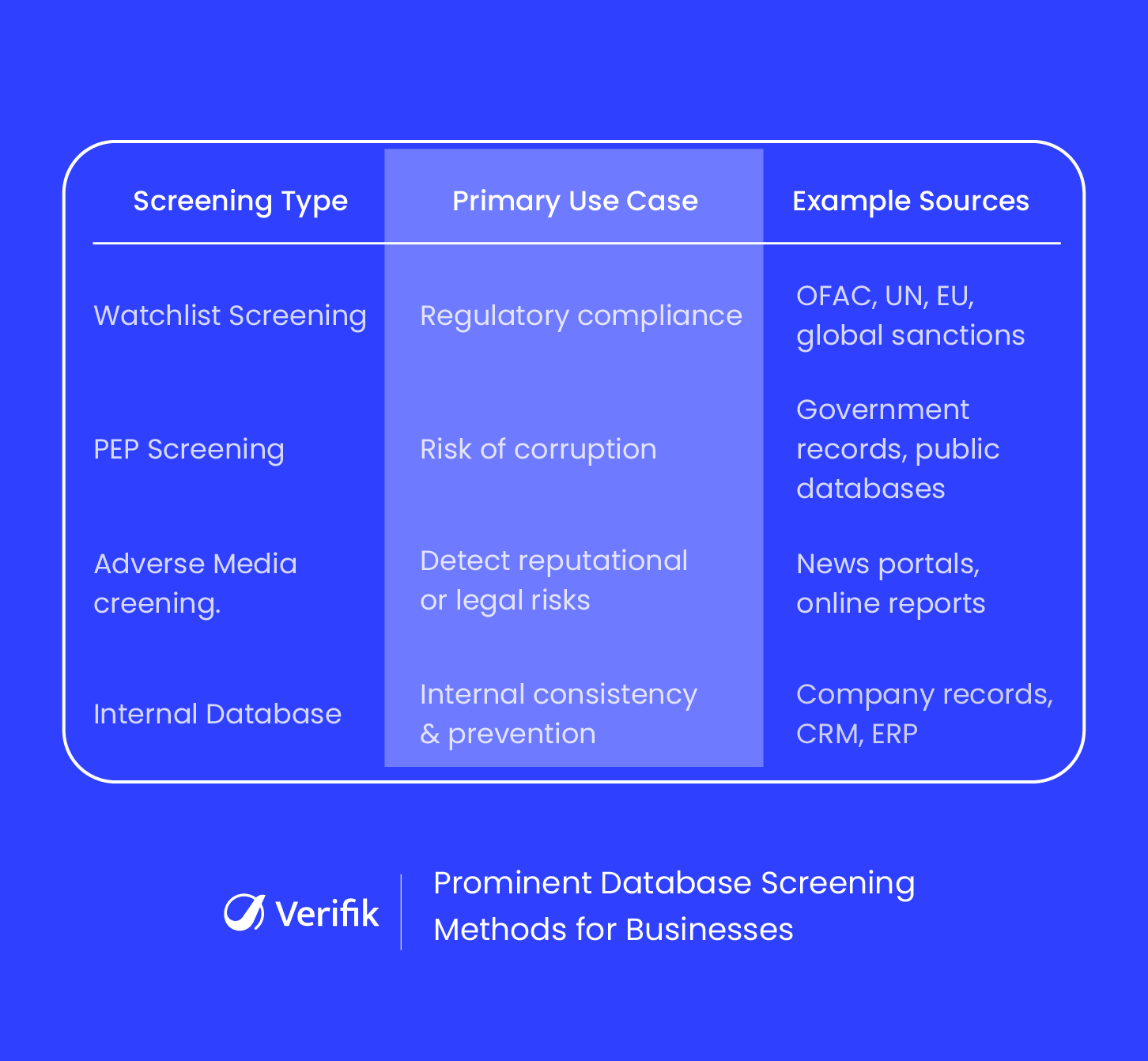

Understanding the different types of database screening helps businesses apply the right checks for their needs. Here are the most commonly used types:

1. Global Watchlist Screening

This involves checking individuals or organizations against international watchlists, sanctions lists, and politically exposed persons (PEP) registries. It ensures compliance with global regulations and prevents engagement with high-risk entities.

2. PEP Screening

Politically Exposed Persons (PEP) screening identifies individuals who hold or have held prominent public positions. Since these individuals may present higher risks of bribery or corruption, PEP screening helps businesses maintain compliance and manage potential reputational exposure.

3. Adverse Media Screening

This type of screening scans news articles, online reports, and public records to uncover negative media coverage or legal issues associated with a person or company. It helps businesses detect potential risks that might not appear in formal watchlists.

4. Internal Database Checks

Companies often maintain internal databases containing client histories, previous transactions, and risk assessments. Screening against these records helps identify repeat offenders or suspicious patterns that could indicate potential fraud.

By combining these types of screening, businesses can build a robust verification process that mitigates risks effectively. The right mix, however, depends on industry requirements, regulatory obligations, and the level of risk associated with clients or partners.

How Database Screening Benefits Different Industries

Database screening delivers significant value across multiple sectors by helping businesses reduce risk, ensure compliance, and protect their reputation. Its benefits often depend on the specific challenges of each sector.

Banking and Finance

Banks and financial institutions operate in highly regulated environments. Database screening allows them to verify clients against global watchlists, detect potential money laundering, and prevent fraudulent transactions. It also helps in assessing creditworthiness and mitigating financial risk, giving banks confidence in every engagement.

BNPL and Fintech

Buy Now Pay Later (BLPL) providers and fintech companies face the challenge of onboarding customers quickly without compromising security. Screening customers against sanctions lists, PEP registries, and credit databases allows these companies to identify high-risk users before offering services. This ensures responsible lending, reduces defaults, and protects the company from reputational damage.

Gambling and Gaming

Gaming platforms, online casinos, and betting operators are subject to strict regulations regarding age verification, anti-fraud measures, and responsible gaming. Database screening helps confirm that players are legally eligible, prevents involvement of banned individuals, and identifies suspicious activity, which keeps these platforms secure and compliant.

HR and Recruitment

For businesses hiring new employees, database screening provides a reliable way to verify backgrounds. Screening can uncover inconsistencies in employment history, check for criminal records, and validate professional credentials. This ensures that companies build a trustworthy workforce, reduce hiring risks, and maintain a safe working environment.

To see how database screening adds value right from onboarding, check out our blog on the “7 Benefits of Database Screening in Digital Onboarding.”

Common Challenges in Database Screening

Even with a database screening solution in place, businesses can face challenges if the process is not carefully managed. Understanding these obstacles helps companies choose the right solution and maximize its benefits.

Data Accuracy and Completeness

One of the biggest challenges is ensuring that the databases used are accurate and up-to-date. Outdated or incomplete information can result in missed risks or false alerts. Businesses must rely on trusted data sources and regularly update their records to maintain accuracy and reliability in their screening process.

False Positives and False Negatives

Screening systems can sometimes flag low-risk individuals as high-risk (false positives) or overlook potential threats (false negatives). Both scenarios can disrupt operations; false positives waste resources and delay onboarding, while false negatives increase exposure to fraud or compliance violations.

Want to explore these issues in more detail and learn how to address them? Read our blog on “Challenges in Database Screening and How to Overcome Them.”

Managing Complex Regulatory Requirements

Regulations around KYC, AML, and sanctions vary across countries and industries. Companies operating globally must ensure that their screening processes meet all local and international compliance standards. Failure to do so can result in heavy fines, legal issues, and reputational damage.

Integration with Existing Business Systems

Database screening is most effective when it integrates seamlessly with CRM, onboarding software, or financial platforms. Poor integration leads to manual processes, slow response times, and gaps in risk management. Businesses must choose solutions that work well with their existing infrastructure.

Handling High Volumes and Real-Time Screening

Businesses with large client bases need real-time screening to maintain efficiency. High volumes of data can overwhelm slow or manual processes, causing delays in customer onboarding and negatively impacting user experience. Automated solutions that handle large-scale screening quickly are essential for modern businesses.

Ready to avoid these common pitfalls? Read our guide on “6 Common Mistakes to Avoid While Doing Database Screening” to learn how.

Key Factors to Consider When Choosing a Database Screening Solution

Choosing the right database screening solution is critical to ensure accuracy, efficiency, and compliance. Not all screening tools are created equal, and selecting the wrong one can leave your business exposed to risk. Here are the key factors to consider:

1. Coverage of Databases and Watchlists

A strong screening solution should include both global and local databases. This typically covers sanctions lists, politically exposed persons (PEPs), adverse media, and internal company records. Comprehensive coverage ensures that your organization 3 {J can identify high-risk individuals and entities no matter where they are located.

2. Accuracy and Reliability

Accuracy is paramount. False positives can waste resources and delay operations, while missed matches can expose your business to serious legal and financial consequences. Look for a solution that pulls data from verified sources, updates frequently, and provides clear matching logic. Reliable systems allow you to take informed actions based on trustworthy information.

3. Automation and Speed

Manual screening can be time-consuming and prone to human error. Automated solutions scan large datasets quickly, identify potential risks, and flag matches for review. Automation not only speeds up the process but also ensures consistency, allowing your team to focus on analysis rather than data gathering. For growing businesses, speed and automation are key to maintaining efficiency without compromising safety.

4. Integration with Business Systems

Your screening solution should integrate seamlessly with other platforms such as customer relationship management (CRM), enterprise resource planning (ERP), or onboarding tools. Integration reduces manual data entry, eliminates duplicate work, and ensures that your screening process fits naturally into existing workflows. A smooth integration can significantly improve operational efficiency and employee productivity.

5. Reporting and Audit Capabilities

Clear, organized reports and a full audit trail are essential. They allow businesses to track screening outcomes, analyze patterns, and demonstrate compliance to regulators or auditors. Good reporting features also help management make data-driven decisions, highlighting potential risk trends before they become serious issues.

6. Scalability

As your business grows, your screening needs will increase. Choose a solution that can scale to handle more clients, partners, or transactions without slowing down or losing accuracy. Scalable systems future-proof your investment and ensure that risk management processes remain effective as volume grows.

7. Data Security and Compliance

Since screening involves sensitive information, the solution must comply with data protection regulations like GDPR or local privacy laws. Secure storage, encryption, and proper access controls are critical. A secure system ensures that sensitive data is protected from breaches while maintaining customer trust.

8. Cost vs Value

While cost is important, it should be balanced against the value provided. A slightly higher-priced solution may deliver broader coverage, higher accuracy, and automated features that save time and reduce risk. Evaluating cost versus long-term benefits helps businesses make smarter investments that protect both finances and reputation.

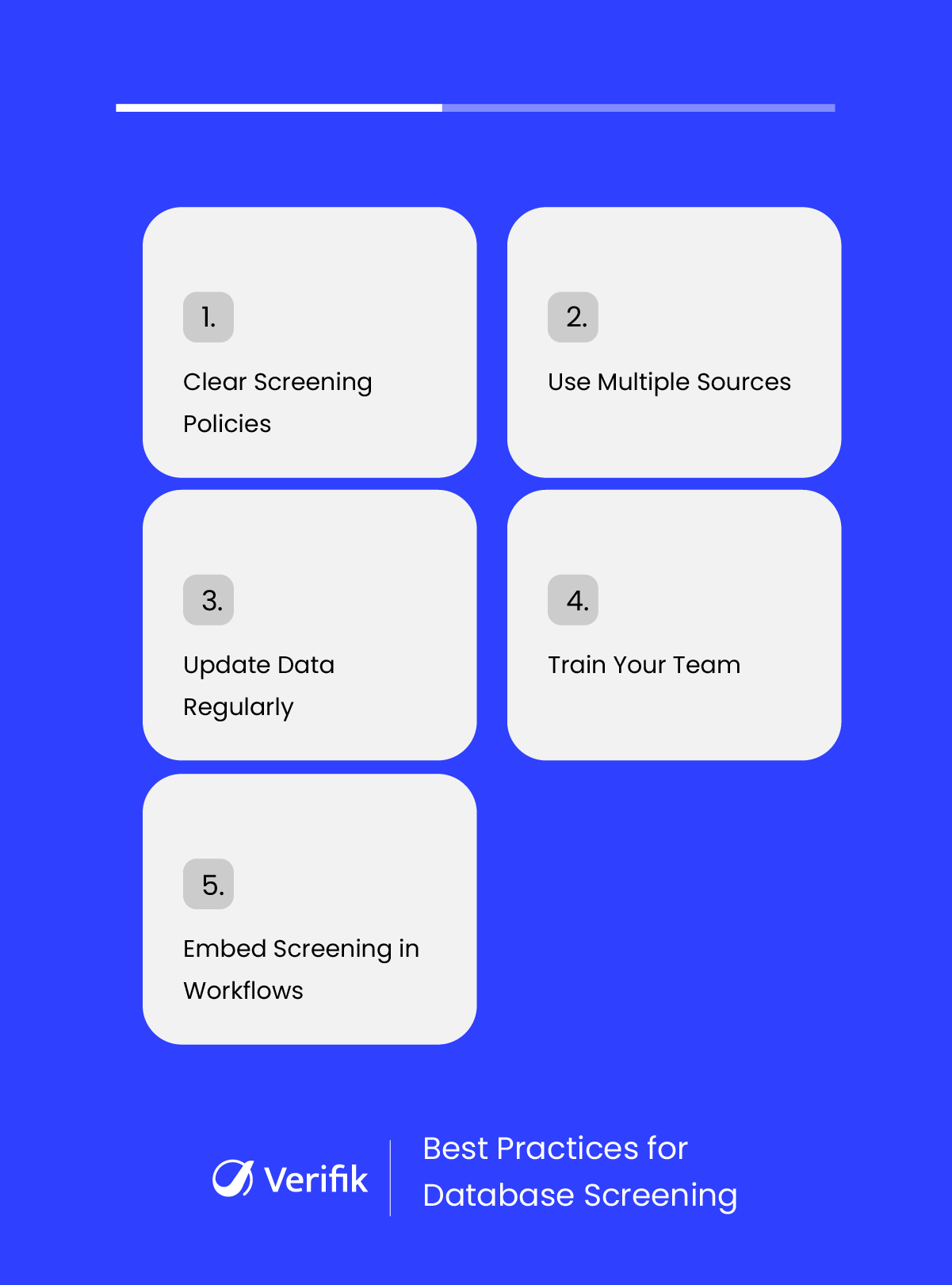

Best Practices for Database Screening

For database screening to work the way it should, businesses need to follow certain practices that keep the process accurate and efficient. Here are five that matter most:

1. Define Clear Screening Policies

Before implementing any tool, businesses should set clear policies about what to screen, how often to screen, and what counts as a risk. Having defined policies avoids confusion, ensures consistency across departments, and makes compliance easier to demonstrate during audits. It also gives teams a clear framework to follow when results need deeper review.

2. Rely on Multiple Sources

No single database can capture every risk. Combining global watchlists, sanctions lists, PEP records, adverse media, and internal data creates a complete picture. This layered approach helps detect risks that might slip through if only one source is used. It also reduces the chance of overlooking emerging threats in industries or regions that aren’t well covered by traditional lists.

3. Keep Data Fresh and Updated

Outdated databases can be just as risky as not screening at all. Regulations change frequently, and so do global risk lists. A reliable screening system should refresh its data daily—or in real time—so businesses always act on the latest information. This keeps compliance strong and minimizes exposure to evolving risks.

4. Train Teams to Read Results

Technology can flag potential risks, but people still make the final call. Teams should know how to separate false positives from genuine threats and understand the context behind flagged results. Regular training ensures staff are confident in interpreting data, taking appropriate action, and handling exceptions without slowing down operations.

5. Integrate Screening into Workflows

Screening should never feel like a separate task. By integrating it into systems like CRM, HR platforms, or onboarding tools, businesses can make risk checks part of the natural workflow. This approach reduces delays, improves efficiency, and ensures that screening happens consistently across the organization without disrupting customer or employee experiences.

Conclusion: Strengthening Risk Management with smartCHECK

Database screening is more than just a compliance requirement. Done right, it protects your business from fraud, reduces regulatory risk, and builds customer trust. The real challenge is choosing a solution that is accurate, efficient, and easy to use.

That is exactly what Verifik’s smartCHECK delivers. With automated real-time screening across trusted global databases, it enables businesses to prevent fraud, speed up onboarding, and stay compliant without adding extra complexity.

See the difference for yourself. Book a free 30-minute demo of smartCHECK today and discover how simple effective screening can be.